- Newly Built In Backtesting Software

- Advanced Dashboard and PnL percentage

- Stocks, Options, Futures, Forex, and Crypto Broker Integration

- Calendar view and Real-time analysis

- Broker API Sync for seamless trade imports

- Track your bad habits and expectancy

- Custom Templates for personalized journaling

- Replay & share trades with mentors to stay accountable

🔥 Limited Offer: Use Discount Code “FX20″ for 20% Off on any Subscription Plan!

These are the best 7 trading journal tools you’ll ever find and they excel in three critical areas for traders:

- Tracking your trades

- Analyzing your performance

- Achieving success

As a trader managing over $600 A.U.M, I can attest to this truth: “Winning traders keep records.“

If you’re serious about taking your trading to the next level, these tools are an absolute must-have.

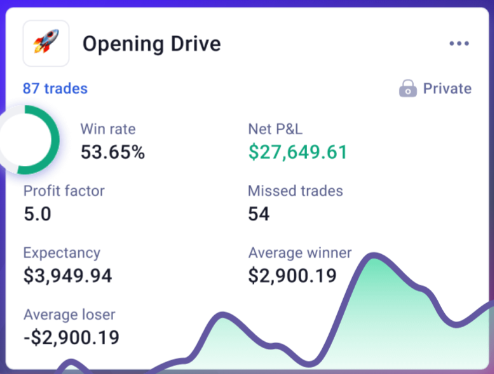

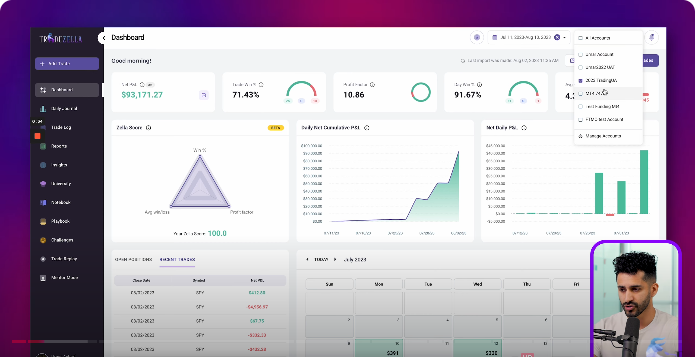

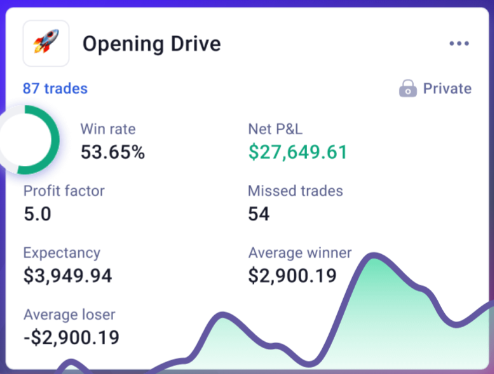

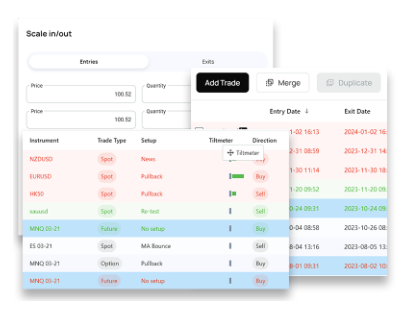

#1: TradeZella

- Newly Built In Backtesting Software

- Advanced Dashboard and PnL percentage

- Stocks, Options, Futures, Forex, and Crypto Broker Integration

- Calendar view and Real-time analysis

- Broker API Sync for seamless trade imports

- Track your bad habits and expectancy

- Custom Templates for personalized journaling

- Replay & share trades with mentors to stay accountable

🔥 Limited Offer: Use Code “FX20″ for 20% Off on any Subscription Plan!

TradeZella is designed with simplicity and effectiveness, offering a seamless journaling experience.

How To Use TradeZella:

Key Features:

- Detailed performance metrics to evaluate trades.

- Easy trade import functionality.

- Clear insights to help traders improve their strategies.

- Bactesting Capabilities {Trades replay}

- Sync or directly import from your brokerage firm

- Access your trading journal anytime, anywhere, with a mobile-friendly design

Why It’s Great:

TradeZella provides actionable insights without overwhelming the user, making it ideal for traders at any level.

Pros of TradeZella

- Flexible pricing options: Accessible for both beginners and professional traders.

- Comprehensive Analytics: This offers advanced metrics and insights to help traders refine their strategies.

- Seamless broker integrations: allow users to import trades via broker sync, file upload, or manual entry

- Psychological Analysis: Helps identify emotional triggers and improve trading discipline.

- User-Friendly Interface: A Simple, clean design makes it easy for traders of all levels to use.

- Customizable Tags: Allows traders to organize and categorize trades effectively.

- Trade Import Feature: Seamlessly import trades from multiple brokers and platforms.

- Actionable Feedback: Provides suggestions to improve trading performance.

- Mobile-Friendly: Access your journal on the go for convenience and flexibility.

- Visualization Tools: Intuitive charts and graphs make performance tracking straightforward.

- Error Analysis: Highlights mistakes to help traders avoid repeating them.

Cons of TradeZella

- No Free Plan: Requires a paid subscription, which may not suit those testing journal tools.

- Focused on Individual Traders: It lacks features for institutional or multi-account management.

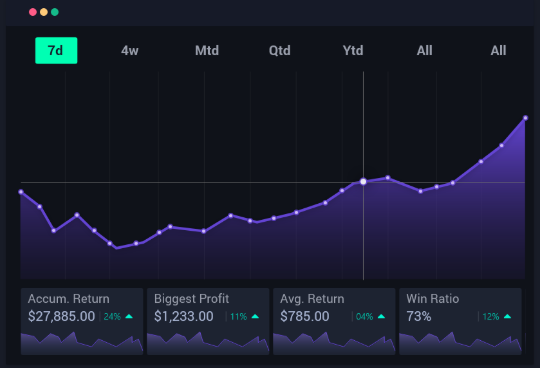

#2: TraderSync

- 7 days free trial

- Track trades with advanced analytics.

- Identify winning and losing patterns.

- Test strategies with simulation mode.

- Accessible on both desktop and mobile.

TraderSync is a highly popular trading journal that focuses on helping traders uncover patterns and improve decision-making.

How To Use Trader Sync:

Key Features:

- Trade Tracking: Record and track all your trades in one place.

- Advanced Analytics: Analyze performance metrics to identify strengths and weaknesses.

- Tagging System: Organize trades with customizable tags and labels.

- Simulation Mode: Test and refine strategies by simulating trades.

- Error Tracking: Spot mistakes to improve decision-making.

- Broker Integration: Import trades directly from supported brokers.

- Performance Insights: Get detailed reports on profitability, win rates, and risk-reward ratios.

- Mobile App: Access your journal on the go with iOS and Android support.

- Custom Reports: Create personalized reports to track specific goals or metrics.

- Trade Replay: Review past trades to learn from successes and mistakes.

Why It’s Great:

Its intuitive design and comprehensive features make it a favorite among traders.

Pros of TraderSync

- Comprehensive Tracking: Tracks all aspects of your trading performance in detail.

- Customizable Tags: Helps traders categorize and analyze trades more effectively.

- Simulation Mode: Unique feature for testing and improving strategies without risking capital.

- Error Identification: Highlights trading mistakes to reduce repetition.

- Broker Integration: Simplifies journaling by importing trades directly.

- Detailed Reports: Provides advanced insights into trading performance.

- Trade Replay: A powerful learning tool for reviewing past trades.

- Mobile Accessibility: Allows journaling and tracking on the go.

Cons of TraderSync

- Pricing: Higher-tier plans can be expensive for beginner traders.

- Learning Curve: Some features may take time to fully understand and utilize.

- Broker Limitations: Not all brokers are supported for automatic trade imports.

- Limited Free Features: Free plan has significant restrictions compared to paid plans.

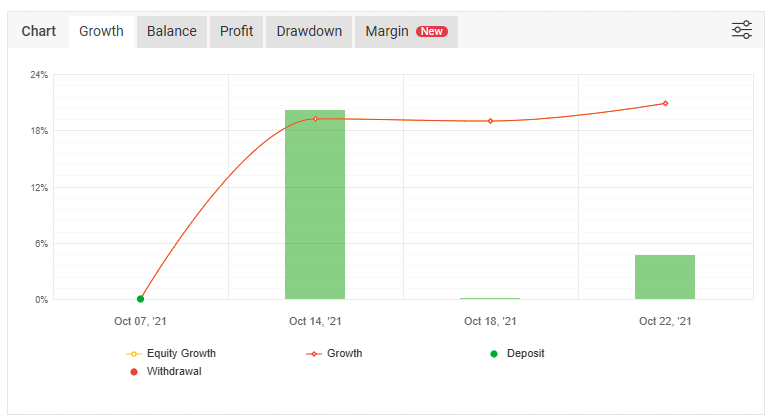

#3 Edgewonk:

- Unlimited Trades

- Unlimited Journals

- Automated Trade Imports

- Works for all Currencies

- Performance Simulator

- Interactive Equity Graph

- Create Report Cards

- Notebook With Image Upload

- Full Customization

Edgewonk is one of the most versatile trading journals available, designed for traders of all levels and asset classes.

How To Use EdgeWonk:

Key Features:

- Psychological analysis to understand emotional patterns.

- Trade analytics to identify strengths and weaknesses.

- Fully customizable tags and metrics.

Why It’s Great:

Edgewonk doesn’t just track trades; it helps you refine your decision-making process.

Pros of Edgewonk

- Comprehensive Analytics: Offers advanced metrics and insights to refine trading strategies.

- Psychological Insights: Provides tools to analyze emotional triggers and improve trading discipline.

- Supports Multiple Assets: Works for forex, stocks, crypto, futures, and other markets.

- Customizable Journaling: Allows traders to add personalized tags and categories for better organization.

- Behavioral Analysis: Identifies patterns and habits to improve decision-making.

- Risk Management Tools: Helps traders optimize position sizing and risk/reward ratios.

- What-If Scenarios: Enables testing strategy tweaks without risking real money.

- User-Friendly Interface: Clean design with intuitive dashboards for easy navigation.

- Platform Agnostic: Works seamlessly on desktop and mobile for on-the-go access.

- Data-Driven Decisions: Delivers in-depth reports to guide performance improvement.

Cons of Edgewonk

- Pricing: May be expensive for beginner traders compared to simpler tools.

- Learning Curve: Advanced features may take time to fully understand and use effectively.

- No Free Plan: Requires upfront investment, which might not appeal to traders on a budget.

- Manual Data Entry: Some users may find entering trades manually time-consuming if auto-import is unavailable.

- Not Broker-Integrated: Unlike some competitors, it lacks seamless integration with certain brokers.

#4: MyFxbook:

- Real-Time Tracking

- Advanced Analytics

- Community Engagement

- Broker Compatibility

- Customizable Reports

- Strategy Testing

- Economic Calendar

- Automated Tracking

- Social Trading

While primarily known as a performance-tracking tool, MyFxBook also serves as an excellent journal for forex traders.

How It Works:

Key Features:

- Automatically sync trades from your MT4 or MT5 accounts.

- Analyze metrics like win rate, drawdown, and profit factor.

- Free to use with basic features.

Why It’s Great:

Its automated data syncing makes it a hassle-free option for forex traders.

Pros of MyFxBook:

- Free to Use: Most features are accessible without any cost.

- Comprehensive Analytics: Offers detailed insights into your trading performance.

- Automated Tracking: Saves time by syncing directly with broker accounts.

- Community Features: Allows users to connect, share ideas, and learn from other traders.

- Strategy Tester: A valuable tool for refining and backtesting trading strategies.

- Economic Calendar: Keeps traders updated on important market events.

- Social Trading: Offers the ability to copy successful traders for better learning and results.

- Wide Broker Support: Compatible with numerous brokers worldwide.

Cons of MyFxBook:

- Privacy Concerns: Sharing account details may make some traders uncomfortable.

- Limited Customization: Some features lack the flexibility of more advanced trading journals.

- Complex Interface: The platform can be overwhelming for beginners.

- Ad-Supported: Free users may experience intrusive ads on the platform.

- Broker Dependency: Full functionality relies on broker compatibility, which may limit some traders.

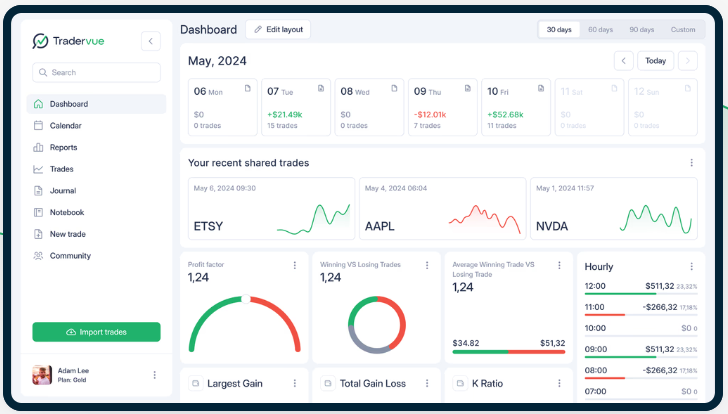

#5: Tradervue

- Trade import from brokers

- Stocks and ETFs

- Automatic price charts on multiple timeframes

- Overview and advanced reports

- Forex & Options support

- MFE/MAE statistics

- Selectable base currency

- Liquidity Reports

- Download/ Export to Excel

Tradervue simplifies trade journaling by offering seamless trade imports and detailed performance metrics.

How To Get Started With TraderVue:

Key Features:

- Effortless Trade Journaling: Quickly import trades from over 100 supported brokers and platforms.

- Advanced Reporting: Gain insights into trading performance with detailed metrics and custom reports.

- Tagging and Filtering: Organize trades with tags and filters for focused analysis.

- Risk Management Tools: Analyze risk/reward ratios to improve position sizing and decision-making.

- P&L Analysis: Break down profits and losses by symbol, setup, or timeframe for actionable insights.

- Community Sharing: Share trades with the Tradervue community for feedback and learning.

- Note-Taking Feature: Add notes to trades to document emotions, strategies, and market conditions.

- Multi-Market Support: Track trades across forex, stocks, crypto, futures, and options.

- Trade Journals: Review historical performance and learn from past mistakes or successes.

- Mobile Accessibility: Access your journal and reports on the go via mobile devices.

Why It’s Great:

Its user-friendly interface and robust analytics make it perfect for both beginners and experienced traders.

Pros of Tradervue

- Wide Broker Support: Compatible with a vast range of brokers and trading platforms.

- Detailed Trade Analysis: Offers advanced metrics like risk/reward ratios, P&L breakdowns, and win rates.

- Tagging System: Helps traders categorize and filter trades for focused reviews.

- Community Integration: Enables trade sharing and feedback within the Tradervue network.

- Custom Reports: Allows traders to generate tailored reports for specific performance metrics.

- Risk Management Insights: Focuses on improving trading discipline and managing risk effectively.

- User-Friendly Interface: Intuitive and easy-to-navigate design for all experience levels.

- Multi-Market Capability: Tracks trades across multiple asset classes, including forex, stocks, and crypto.

- Affordable Plans: Offers a free plan with basic features and paid plans for more advanced needs.

Cons of Tradervue

- Limited Free Plan: The free plan lacks advanced features like reporting and risk analysis.

- Subscription Costs: Advanced features require a monthly subscription, which may deter beginners.

- No Automated Strategy Testing: It lacks built-in tools for backtesting trading strategies.

- Learning Curve: New users may take time to fully utilize its advanced features.

- No Mobile App: While mobile-friendly, it lacks a dedicated app for streamlined access.

#6 JournalyTix:

- Customizable Alerts

- Detailed performance metrics to evaluate trades.

- Easy trade import functionality.

- Clear insights to help traders improve their strategies.

- Desktop and Cloud Access

Journalytix is a real-time trade journaling and analytics platform that integrates news and alerts for a complete trading experience.

Key Features:

- Real-Time Trade Journaling: Automatically sync trades from supported brokers for instant journaling.

- Advanced Analytics: Access in-depth metrics, including win rates, drawdowns, and performance by strategy.

- Risk Management Tools: Optimize your trading with tools to analyze risk/reward ratios and position sizing.

- Performance Tracking: Monitor progress with detailed charts and reports tailored to your goals.

- Emotional Tracking: Document your emotional state during trades to identify behavioral patterns.

- Trade Tagging: Organize and filter trades by tags for targeted analysis.

- Custom Alerts: Set up notifications to stay updated on key market events or personal performance metrics.

- Educational Integration: Learn from in-platform tutorials and expert trading insights.

- Multi-Asset Support: Compatible with forex, stocks, crypto, and other asset classes.

- Desktop and Cloud Access: Available both as a downloadable app and via the cloud for flexibility.

Why It’s Great:

Its integration of real-time data makes it a powerful tool for traders who want to stay informed and agile.

Benefits of Using Journalytix

- Real-Time Trade Journaling: Automatically sync trades from supported brokers for instant journaling.

- Advanced Analytics: Access in-depth metrics, including win rates, drawdowns, and performance by strategy.

- Risk Management Tools: Optimize your trading with tools to analyze risk/reward ratios and position sizing.

- Performance Tracking: Monitor progress with detailed charts and reports tailored to your goals.

- Emotional Tracking: Document your emotional state during trades to identify behavioral patterns.

- Trade Tagging: Organize and filter trades by tags for targeted analysis.

- Custom Alerts: Set up notifications to stay updated on key market events or personal performance metrics.

- Educational Integration: Learn from in-platform tutorials and expert trading insights.

- Multi-Asset Support: Compatible with forex, stocks, crypto, and other asset classes.

- Desktop and Cloud Access: Available both as a downloadable app and via the cloud for flexibility.

Pros

- Real-Time Syncing: Automatically logs trades without manual input, saving time and effort.

- Comprehensive Analytics: Offers robust metrics to analyze trading strategies and performance.

- Emotional Tracking: Helps traders understand the impact of emotions on decision-making.

- Customizable Alerts: Allows users to set reminders for key market updates or personal goals.

- Educational Tools: Includes resources for traders to improve their skills and strategies.

- Cross-Asset Compatibility: Supports a wide range of trading instruments, making it versatile.

- User-Friendly Interface: Intuitive design ensures accessibility for traders of all experience levels.

- Cloud and Desktop Options: Provides flexibility for accessing your data anywhere.

- Integration with Brokers: Syncs seamlessly with many trading platforms for hassle-free journaling.

Cons

- Price: Subscription plans can be costly, especially for beginner traders.

- Learning Curve: Advanced features may require time to master for less experienced users.

- Broker Dependency: Full functionality depends on compatibility with supported brokers.

- No Mobile App: While cloud access is available, the lack of a dedicated mobile app may be inconvenient.

- Limited Free Features: The platform’s free version has restricted functionality, requiring a subscription for full access.

#7 TradingDiary Pro:

- Offline Access

- Data Security

- Equity Curve Tracking

- Multi-Asset Support

- Customizable Reports

- Advanced Performance Analytics

- Comprehensive Trade Journaling

For active traders looking for a comprehensive solution, TradingDiary Pro offers in-depth trade planning and risk management tools.

Key Features:

- Comprehensive Trade Journaling: Track all trades with detailed entry, exit, and performance data.

- Advanced Performance Analytics: Gain insights into your trading performance with metrics like win/loss ratios, drawdowns, and expectancy.

- Customizable Reports: Generate reports tailored to your specific trading strategies and goals.

- Multi-Asset Support: Works with various trading instruments, including stocks, forex, crypto, and options.

- Broker Integration: Import trade data directly from supported brokers or trading platforms.

- Trade Tagging and Filtering: Organize trades by tags and use filters for precise analysis.

- Risk Management Tools: Analyze risk/reward ratios and improve position sizing for better outcomes.

- Equity Curve Tracking: Visualize your account growth over time to identify trends.

- Offline Access: Desktop-based software allows access without internet connectivity.

- Data Security: Your trading data is stored locally, offering more control over privacy and security.

Why It’s Great:

It’s designed for traders who want to take a deeper dive into their performance metrics.

Pros:

1. Detailed Analytics: Provides in-depth insights into trading performance to help improve strategies.

2. Customizable Reports: Allows traders to generate personalized reports for better decision-making.

3. Multi-Asset Support: Suitable for traders handling different asset classes.

4. Local Data Storage: Ensures privacy and control by storing data on your device.

5. One-Time Purchase Option: Offers a one-time payment model instead of recurring subscriptions.

6. Tagging and Filtering: Makes it easy to analyze specific types of trades or strategies.

7. Import Flexibility: Allows trade data imports from a variety of brokers and trading platforms.

8. Offline Usability: Does not require constant internet access, making it ideal for remote use.

Cons

1. No Cloud Access: Data is stored locally, limiting accessibility across devices.

2. Outdated Interface: The design and user interface feel less modern compared to competitors.

3. Steep Learning Curve: Advanced features may be overwhelming for beginners.

4. Limited Broker Compatibility: Not all brokers platforms are supported for direct imports.

5. Desktop-Only: No mobile app or cloud integration for on-the-go tracking.

6. Upfront Cost: The one-time purchase may feel expensive for some traders, especially those just starting.