According to the Binance, around 90% of traders lose money in the long run.

Even CNBC says that over 97% of traders who persisted in trading lost money.

Have you ever wondered why this many traders fall short and end up losing money in the forex market?

Some say it’s because of not having the best trading strategy, which is certainly not true, forex trading is simply beyond that.

With this evidence from reputable sources, as forex traders, you’re forced to ask the question- Is Forex A Losing Game?

These pressing inquiries arise from the overwhelming evidence that 90% of traders struggle to achieve consistent profitability in this market.

But only 10% of traders usually finds success and that leads us to the one next line.

Key Takeaways:

- Forex trading isn’t inherently a losing game, despite common misconceptions among traders.

- 90% of traders fail due to poor risk management, lack of adaptability, and emotional trading.

- Successful traders always make capital protection their first assignment and adhere to a well-detailed trading plan.

- Unrealistic profit expectations and lack of education contribute to failure among traders in forex trading.

Is Forex A Losing Game?

The answer is no! Forex is not entirely a losing game.

Most people think so because at one point in their life, they must have heard that someone somewhere lost a huge amount to the market.

Or come across posts like this..

The misconception that Forex is inherently unprofitable stems from anecdotal stories of individuals who have suffered substantial losses in the market.

Unfortunately, these stories have spread widely, leading many to believe that Forex trading is not a profitable business.

But I will tell you for a fact that forex trading is not a losing game and it is a very profitable business model when practiced with proper education.

I’ll tell you why?

Why do 90% of Traders Fail and Lose Money?

I’ll tell you why?

Poor Risk and Money Management

Many traders think that they are good to go once they have gotten the so-called “holy grail” strategy.

This is far from the truth and also boils down to why most traders fail.

to avoid this mistake, you should always learn, as traders, to master your risk and money management skills before jumping into the market.

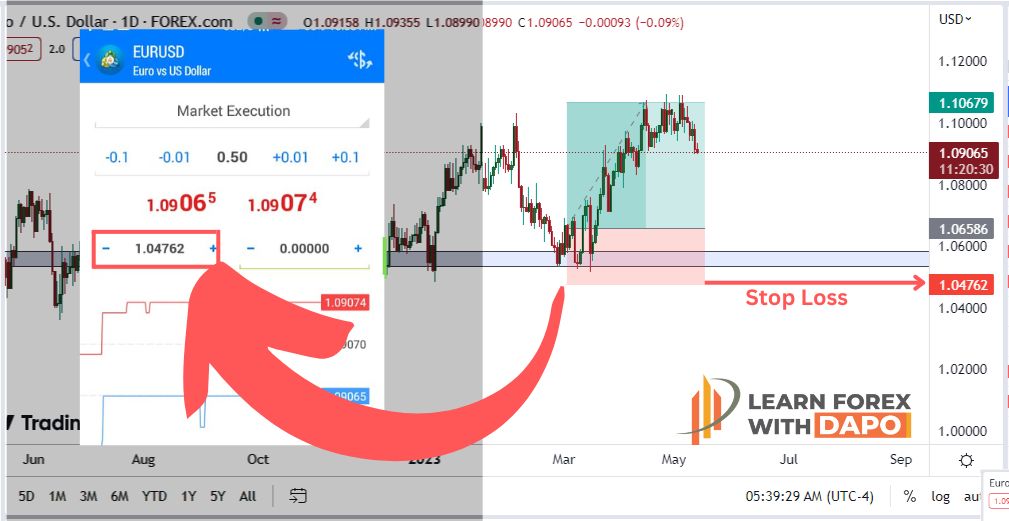

The stop-loss and take-profit automated responses on your trading software are not just for fun!

Please make use of them to avoid losing money in the forex market.

Guess what?

Some traders don’t even put stop-loss in their trades out of fear of being stopped out quickly.

This step leads to a loss of capital in trading.

As a trader, you should always be aware of the risk involved in every trade you place so as to protect your capital.

The investor’s mindset is- Capital protection is the main priority!

In a way to protect capital more effectively, investors usually have at least two separate accounts—one for the high-risk trades and the other for the low-risk trades.

This method would ensure that you don’t blow up your trading account.

Rigidity to Market Conditions

Rigidity to market conditions, which is just a fancy description of not wanting to adapt to market conditions, is another reason why traders fail and lose a lot of money.

As we all know, the market is moving continuously thereby making the market dynamic in nature.

Due to this, every trader needs to continuously adapt to market conditions by making some little changes in their strategy each time they plan a trade.

Also, this ever-changing nature of the market brings about new juicy opportunities and also the risks tied with them.

This is because no one static strategy is enough to become profitable in an ever-changing market.

So, you can adapt to the dynamic nature of the market by conducting a scenario analysis.

By doing this, you plan for the moves in your favor and the reasons why the market can move against you.

Lack Of Trading Discipline

Lack of trading discipline is the inability of a trader to have their emotions in check when trading.

Allowing emotions to take charge of their trading, is what makes most traders fail.

Success in trading is achieved by a few big wins while suffering from many smaller losses.

No one likes to lose to the market.

But this is inevitable in trading. So, don’t try to fight back your losses.

If you do, you open yourself to trading dangers such as overtrading, fear of missing out, and greed which are all enemies to success in trading.

To overcome this, you need to have a well-detailed trading plan.

Failure to adhere to a trading plan

Do you remember the popular adage that says- failing to plan, is planning to fail?

This adage is true in all phases of life and trading is not an exemption.

As a matter of fact, it is a huge step to success in trading.

Failing to adhere to a trading plan is another defect most traders suffer from, leading to a terrible trading career.

Most of the time, they fail to adhere to their plan because of their emotions, usually fear of missing out. Popularly known as FOMO.

A successful trader follows a very well-written and documented trading plan that contains the entry and exit criteria, the risk involved, and the potential return on investment (ROI) on each trade at the very least.

So, if you follow a strict trading plan, you will escape safely from the usual trading traps.

Unrealistic Expectations

Many retail traders come into the forex market with the mindset of accumulating lots of profits within the shortest period.

But, this is the wrong mindset to start forex trading.

As with every other business, accumulating profits in forex is also a marathon and not a sprint, because forex is not a get-rich-quick scheme.

It takes years of continuous learning and adaptation to accumulate long-term and sustainable wealth.

Traders should learn to have realistic expectations from the market and not try to bend their trading rules to gamble on gains by risking more capital that is not feasible.

This usually happens when they throw their trading discipline out the window.

Lack of Education

The quickest way to fail in currency trading is a lack of education.

When you lack sufficient knowledge on how to navigate your way through the forex market, it is most likely that you lose a lot of money.

Some say- “Ohhh I can learn from my mistakes” but this also is rather a very expensive and inefficient way to learn to trade the currency market.

The most efficient way to become successful in trading is by learning from very well-experienced traders with proven profitable track records.

By doing this, you are sure that you’re in safe hands and would be able to escape the trap that most traders fall into.

You would also be exposed to the not-so-common costly mistakes that traders make, probably the ones that your mentor had made.

You can also learn from the strategies of your mentor and from there build your own strategy.

Not Enough Capital

Another very common reason why most forex traders fail is that they do not have enough capital in relation to their position size.

As traders, we know that the more capital you have, the more reasonably higher your ROI would be especially if you use your leverage opportunity wisely.

Speaking of leverage, this is the opportunity given by brokers to traders to increase their ROI and achieve a reasonable profit.

Leverage is a two-faced blade that can either increase your potential gains in some cases or amplify your losses in others leading to serious injury to your trading account.

Most forex brokers offer a 400:1 leverage to traders.

This huge opportunity to potentially control large sums gets into traders’ heads and makes them use it abnormally. Just because the offer is there doesn’t mean you should use them.

The act of misusing the leverage opportunity is usually carried out by those traders who don’t have enough capital.

And the reason is not far-fetched.

It’s simply because they want to amass huge profits within the shortest period with their small capital.

So, how exactly does Leverage work?

To understand this concept of leverage, you need to know what margin is.

So, what is Margin?

Margin is simply a deposit you make on every trade to prevent your broker from incurring potential losses on a trade.

The amount of leverage offered depends on the amount of margin required by your broker.

So, if a trade goes against you, and there is no longer enough capital for you to mitigate the loss, there would be a margin call by the broker for you to provide more capital.

And if that is not done, they sell your open positions at a loss to recoup their capital.

Remember I told you that the amount of leverage offered depends on the amount of margin required?

Here is how they relate.

For a 5% margin, your broker would offer a maximum of 20:1 leverage.

This means that you have the opportunity to control a position size that requires 20 times your initial deposit.

Let me break it down thoroughly.

Let’s take for example, you have a $10,000 deposit in your account, and your broker offers a maximum of 20:1 leverage, this means you can control a position size of $200,000 in the live market.

Now, let’s say the exchange rate of a EUR/USD pair moves in your favor by 1%.

Without this leverage, your profit would have been $100 i.e 1% of your $10,000 capital.

However, because of the leveraging opportunity, your profit is magnified 20 times.

This means you have a profit of $2,000.

Conversely, if the market moves against you, this means your loss could be $2,000!

This tells you that you need to be extremely careful when using leverages.

Do you now get the gist? I hope so.

Below is the list of margins and the maximum leverage offered by most brokers.

| Margin | Maximum Leverage |

| 5% | 20:1 |

| 2% | 50:1 |

| 1% | 100:1 |

| 0.5% | 200:1 |

| 0.25% | 400:1 |

Now, here is a task for you.

Give an illustration for a 1% margin using the example I taught you above.

This would test if you have gotten the gist. If not, read through it again.

There is also another effect of leverage.

Now, when a trade is executed, there are transaction costs involved.

Let’s say the currency pair being traded has a spread of 5 pips.

Spread is the difference between the buying and selling price and each pip represents a small unit of price movement.

So, with a five-pip spread, the trader incurs a cost of $25 in total: (1 pip x 5 pip spread) x 5 lots.

Here’s where it gets interesting.

Even before the trade starts to make or lose money, the trader needs to catch up because the $25 in transaction costs is 5% of their account value ($500 from the initial example).

In other words, the transaction costs already represent a significant portion of their account value.

This means, the higher the leverage the trader uses, the higher the transaction costs will be as a percentage of their account value.

Final Words

By addressing these common pitfalls and developing sound trading strategies, you can improve your chances of success in forex trading.

It only requires continuous learning, adaptability, discipline, and proper risk management to achieve consistent profitability in the forex market.

As I’ve said in this article, the easiest way to avoid these pitfalls is by learning from a successful trader who has a proven record and is well-experienced in the field.

If you want to learn to become successful like myself, then waste no time further.

The Forex mastery course has been changing the lives of students who have purchased it and it has now made them profitable.

Why not join the moving train?

Good luck with trading.