The foundation of successful trading lies in understanding your entry and exit points for each position taken, a fact that experienced traders are well aware of.

And that is because your analysis can be accurate, but your trade can still result in a loss if you don’t know when to enter and exit at the right time.

Timing is critical in trading, and making the mistake of entering a trade at the wrong time can result in significant losses or limits your profits. Which is the bad news.

The Good news is Price action is the most favored method of analysis for investors and traders that allowing them to determine their entry and exit points for a position.

By utilizing this method, traders can improve their profitability, achieve a favorable risk-to-reward ratio, and increase their confidence in their trading decisions.

Key Takeaways

- In order for you to implement any strategy, you have to study and understand price action, develop a comprehensive trading plan, implement it consistently, and continuously learn and improve.

- Avoid common mistakes like trading without a plan, using overly complicated strategies, not setting stop-loss orders, and ignoring price action indicators.

- Always keep your strategy simple and consistent and improve based on market trends and personal experience gathered.

Spoiler Alert: This approach to trading is suitable for both novice and experienced traders.

If that is what you want, then let’s dive in!

What are price action entry strategies?

Price action entry strategies are the strategies that you deploy to guide you into taking trading positions.

They help you to know when exactly to pull the trigger.

Without further ado, let’s talk about the different entry strategies you can use to maximize your trading success.

Effective Price Action Entry Strategies (90% Success Rate)

Let us cut to the chase.

I have pulled out (4) of the most effective entry strategies with a 90% success rate when used in conjunction with price action or a proven trading system that works.

These are entry points I have been using throughout the years of my profitable journey as a forex trader.

And it works well for me and over 100+ of my students who found success with it.

Trendline breakouts:

Trendline breakout involves identifying a trendline and entering a trade when the price breaks above or below the trendline.

The break above or below the trendline can be identified and confirmed by using reversal candlestick patterns such as engulfing candlesticks, rejection candlesticks, etc.

Now let’s look at a chart example for trendline breakout entry strategy

Support and resistance levels:

Key levels, such as support and resistance, where the price has previously bounced off provide traders with an opportunity to enter a trade when the price reaches those levels.

This strategy only requires you to buy at support and sell at resistance. Simple!

Look at the AUDUSD chart below as an example of support and resistance entry.

False breakouts:

This entry strategy involves looking for price movements that initially appear to be breakouts, but then quickly reverse.

When the price does this, you enter a trade in the opposite direction of the false breakout.

This strategy helps you to avoid being caught in market manipulation.

Also as a beginner, you should practice over and over again before you start using this strategy.

This is because a lot of expertise is required.

Here is a chart example of how to enter trades using false breakouts

Reversal patterns strategy:

The reversal pattern entry strategy involves looking for specific patterns in price movements that indicate that a reversal is likely to occur.

Some common reversal patterns include the head and shoulders pattern, the double top pattern, and the double bottom pattern.

Using the head and shoulders pattern, let’s see below how you can enter a trade.

Also, let’s see how double tops can help you enter into trades.

Do you see how easy it is? Exactly!

Click here to learn more about reversal patterns.

Since you know how to get into trades, it is only proper that you know how and when to get out of your existing trade positions. Isn’t that right? Yes, it is.

This leads us to the next section…

What are price action exit strategies?

Price action exit strategies are the strategies that help to exit a trade.

These strategies help to protect you from further losses when the market moves against you and also, it helps to take in your profit for you and store them when the price gets to your profit target.

The most interesting aspect of this is, they can be automated.

Hence you don’t have to wait before your screen to exit a trade. How interesting!

So, what are these strategies?

Powerful Price Action Exit Strategies to Protect Your Trading Profits

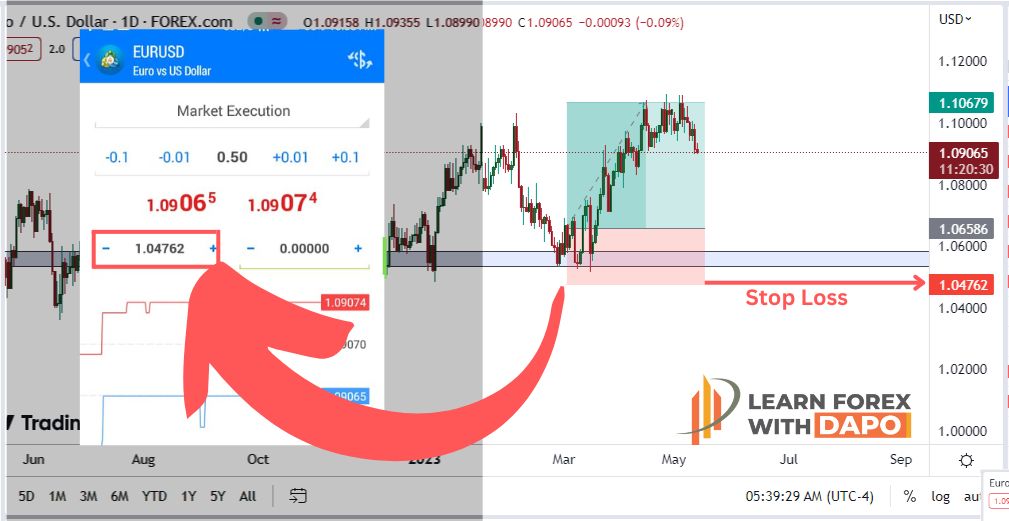

Stop Loss Order:

A stop-loss order is a pre-set order that you put in place so that when the market moves against you to a certain level, then you exit the market.

This order can be automated and helps to prevent you from further losses while you’re away from your computer.

Take profit order:

The take-profit order is also a pre-set order that you put in place so that when the price moves in your favor to a predetermined level, you lock in your profit.

Take-profit orders can also be automated using your MT4, MT5, or whatever software you choose to use.

Trailing stop orders:

Trailing stop orders are manually set orders usually put in place when the market is moving in your favor.

This type of order protects you from sudden changes in market conditions and helps you rake in more profits.

Disclaimer: As a beginner, I would advise you to stay away from this type of exit strategy as it requires a lot of experience.

Price action signals:

Price action signals are reversal indicators provided by the price action itself through reversal candlesticks and chart patterns.

For example, let’s imagine you’re in a bullish trend and you suddenly spot a bullish reversal candlestick like the bearish engulfing, this candlestick signifies for you to exit a trade.

Support and resistance:

Support and resistance can be used to identify exit positions.

Let’s take for instance that if you enter into a long trade at the key resistance level, and the market approaches a key support level, you would want to exit your position at that level.

Now that you have been equipped with the different entry and exit strategies that can improve your trading success, it is only right that you also know how to implement these strategies.

Steps of Implementing a Successful Price Action Entry & Exit Strategies

When you want to implement the entry and exit strategies you have learned here, you need to follow these four key steps.

These steps are:

Study and Understand Price Action:

When you want to implement the strategies that you have learned, you need to study and understand the concepts of price action and technical analysis (learn more).

Develop a comprehensive trading plan:

As a trader, you should develop a comprehensive trading plan that includes the entry and exit strategies that you have learned, risk management techniques, and other important trading considerations.

Implement the plan consistently:

One thing is to develop a trading plan, another thing is to implement the trading plan consistently. Hence, you must implement your trading plan consistently to achieve long-term success.

This requires discipline and the ability to stick to the plan, even in the face of unexpected market movements, which many traders lack.

But you should not lack these necessary qualities.

Continuously learn and improve:

You also must continuously learn and improve your trading skills to stay ahead of the curve.

You improve by staying up to date with market news and trends, as well as studying successful traders and implementing their techniques into their own trading strategies.

Now, in setting up these price action strategies, a lot of newbies make some mistakes that can be avoided.

Let me walk you through these mistakes so as not to fall into these traps.

Common Mistakes Traders Make When Setting Up a Price Action Entry and Exit Strategies

One of the biggest mistakes traders, especially newbies, make when setting up a price action strategy is trading without a plan or strategy.

And without these clearly written plans, they fall into the trap of making impulsive decisions based on emotions rather than logical analysis.

Some other common mistakes include using overly complicated strategies which often involve using indicators, failing to set stop-loss orders, and ignoring important price action indicators.

Now that you’re aware of these mistakes, you should always try not to fall into traps like these.

Some of you might be wondering, what is the right way to set up a winning price action entry and exit strategies for long-term trading success?

Do not worry as this question is answered in the next subtopic.

The Right Way to Set Up a Winning Price Action Entry and Exit Strategies for Long-Term Trading Success

For you to set up a winning price action strategy for long-term success, you should focus on simplicity and consistency.

Here’s a secret of trading- the simpler your strategy is, the more profitable you become.

You should come up with a very comprehensive trading plan that includes a clear entry and exit strategy, risk management techniques, and a plan for continuous learning and improvement.

And as I have mentioned earlier, it’s also important for you to maintain discipline and consistency in implementing the plan, while continuously adapting and improving based on market trends and personal experience.

Conclusion

Price action entry and exit strategies are an important tool for traders, like yourself, seeking to profit from market movements.

By analyzing price patterns and making informed trading decisions based on price action, you can identify profitable trades and protect your profits with effective exit strategies as shown to you above.

Finally, to achieve success with price action strategies, you must, again, focus on simplicity, consistency, and continuous learning and improvement, while also maintaining discipline and emotional control in the face of unexpected market movements.

Good luck.