- Multi-Timeframe Backtesting

- Replay Price Action by the Second

- Up to 10 Years of Historical Data

- Advanced Risk Management

- Seamless Trade Journaling

- Economic Calendar Integration

- Custom Templates for Strategy Testing

Backtesting is a critical part of developing a profitable trading strategy.

Whether you’re a forex, futures, stock, or crypto trader, choosing the right backtesting software can make a huge difference in the accuracy and efficiency of your strategy testing.

To help you decide, we tested multiple backtesting platforms based on accuracy, ease of use, speed, data availability, and pricing.

Here’s what we found.

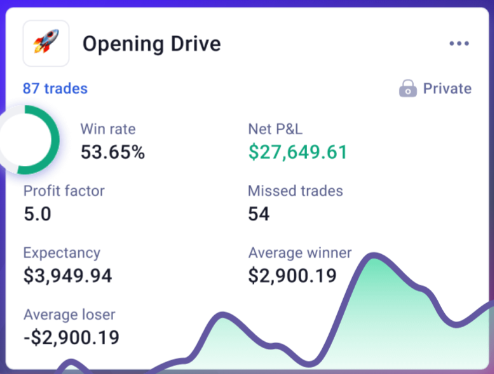

1. TradeZella – Best for Trade Journaling & Analytics

Why We Liked It:

TradeZella is a powerful trade journaling software that also offers backtesting capabilities, making it great for traders who want to analyze their past trades while refining their strategies.

Pros:

- Advanced trade journaling and analytics

- Backtesting integrated with trade history

- Cloud-based with a user-friendly interface

Cons:

- Subscription-based pricing

- Limited automation for backtesting

Best For:

Traders who want an all-in-one trade journaling and backtesting solution.

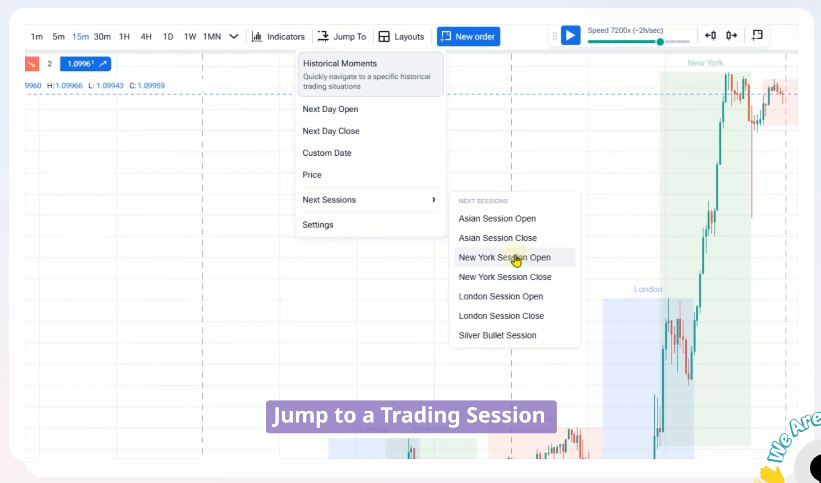

2. TradingView – Best for Ease of Use

Why We Liked It:

TradingView is one of the most user-friendly platforms for both manual and automated backtesting.

The “Bar Replay” feature allows traders to manually test their strategies on historical data, while Pine Script enables automated strategy testing.

Pros:

- Easy-to-use interface

- Supports multiple asset classes

- Cloud-based, no installation required

- Large community sharing scripts and strategies

Cons:

- Limited historical data for free users

- No fully automated walk-forward testing

Best For:

Traders who want a simple, web-based backtesting tool with a large community for ideas and scripts.

3. TraderSync – Best for Data-Driven Insights

Why We Liked It:

TraderSync helps traders track, analyze, and backtest their trading strategies based on historical data and performance metrics.

Pros:

- AI-powered trade analysis

- Detailed trade journaling with performance metrics

- Cloud-based platform with mobile access

Cons:

- Subscription required for premium features

- Not ideal for fully automated backtesting

Best For:

Traders who rely on analytics and trade journaling for backtesting their strategies.

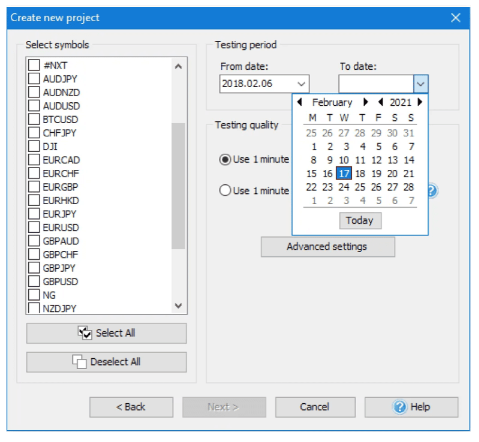

4. Forex Tester – Best for Manual Forex Backtesting

Why We Liked It:

Forex Tester is dedicated solely to forex strategy backtesting.

It offers excellent historical data and the ability to replay market conditions.

Pros:

- Large forex historical data sets

- Supports manual and automated backtesting

- No need for a broker connection

Cons:

- Forex-only

- Paid software

Best For:

Forex traders who want in-depth historical testing without broker limitations.

5. MetaTrader 4 & 5 – Best for Forex Traders

Why We Liked It:

MT4 and MT5 are staples in the forex trading world.

The Strategy Tester feature allows traders to backtest Expert Advisors (EAs) on various timeframes.

Pros:

- Free to use with most brokers

- Large database of trading algorithms (EAs)

- Customizable with MQL4/MQL5 programming

- Supports tick data testing (MT5)

Cons:

- Can be complex for beginners

- Limited to forex and CFDs

Best For:

Forex traders who use automated trading strategies and need precise backtesting with broker-specific data.

6. NinjaTrader – Best for Futures & Stocks

Why We Liked It:

NinjaTrader offers powerful backtesting capabilities for futures and stock traders.

The platform supports tick-by-tick data testing and allows traders to write scripts using C#.

Pros:

- Tick-by-tick accuracy

- Advanced order execution simulation

- Supports multiple data feeds

- Strong community and developer support

Cons:

- Steep learning curve

- Paid license required for full features

Best For:

Serious traders focusing on stocks, futures, or high-frequency trading who need advanced backtesting accuracy.

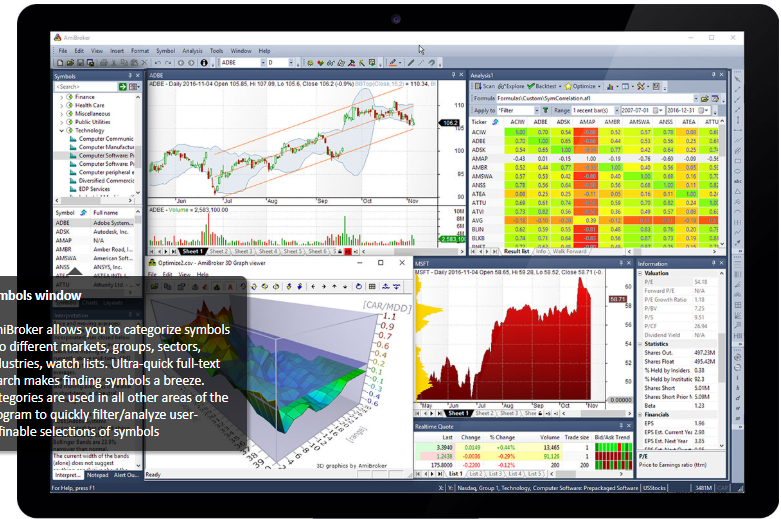

7. Amibroker – Best for Speed & Customization

Why We Liked It:

Amibroker is a fast, highly customizable backtesting software that is great for traders who prefer coding their strategies.

Pros:

- Lightning-fast backtesting engine

- Supports custom scripting (AFL – Amibroker Formula Language)

- Large user community for script sharing

Cons:

- Not beginner-friendly

- Requires paid license

Best For:

Traders who need high-speed backtesting and are comfortable with coding.

Final Verdict: Which One Is Best?

The best backtesting software depends on your trading needs:

- Best Overall (Ease of Use): TradeZella and TradingView

- Best for Trade Journaling & Analytics: TradeZella

- Best for Data-Driven Insights: TraderSync

- Best for Forex Manual Backtesting: Forex Tester

- Best for Forex Automation: MetaTrader 4 & 5

- Best for Stock & Futures Traders: NinjaTrader

- Best for Speed & Customization: Amibroker

For most traders, TradingView offers a great starting point.

However, if you’re serious about automated trading, MT4/MT5 and NinjaTrader provide more advanced options.

If you prioritize trade journaling alongside backtesting, TradeZella and TraderSync are excellent choices.

For forex traders seeking dedicated historical testing, Forex Tester is highly recommended.

Have you tested any of these platforms?

Let us know your experience in the comments!