Yes, prop firms can make you rich because they provide access to larger trading capital, allowing you to scale up your trading career and earn decent returns by trading multiple asset classes.

Not only that, they manage your risk, and you take the rewards.

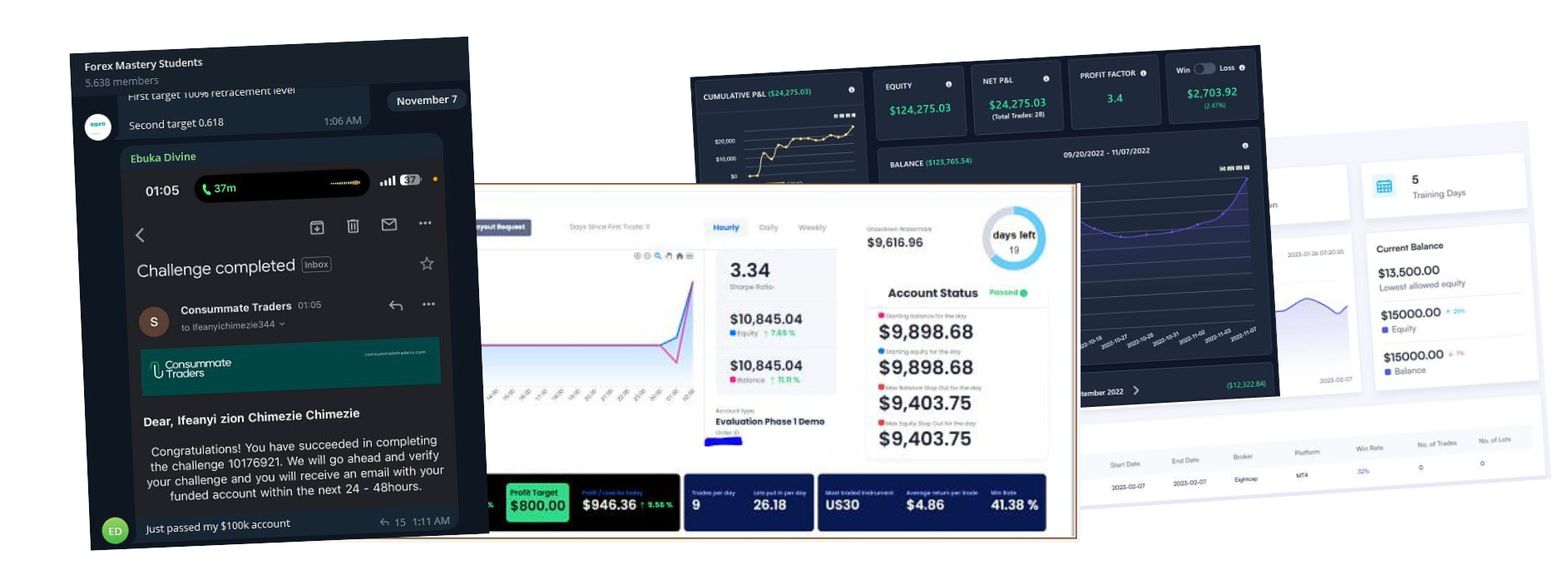

Just like this trader who enrolled in our $10,000 skill-check program.

Made $3,028, and $2725 was sent to him based on a 70/30 profit-sharing model.

Technically, he had zero risk, 10000% of the rewards…

And he’s not alone; other traders are raising over $200,000 in funding from prop firms.

Don’t miss out!

Prop firms are creating more millionaire traders in today’s financial markets.

Why Should You Trade Prop Firms?

To turn $0 into a million dollars as a trader, it’s best to get money from wealthy investors.

You need money, not just a strategy to make small amounts grow quickly.

It comes down to how well you talk to these wealthy investors, your track record in trading, and the terms of your agreement.

This approach worked for me, and I realized something.

Most traders are either shy and find it hard to talk to wealthy investors, or they aren’t good at communicating.

So, what’s the solution? Proprietary (prop) firms are the new heroes.

Since 2015, things have changed.

While getting funds from investors is still a good idea, prop firms have changed trading.

Now, you can trade comfortably from home with up to $250,000, without having to deal with the challenges of talking to wealthy investors.

Prop firms offer a way to build wealth without the usual problems.

You Take The Rewards While They Manage Your Risk:

For instance, this trader enrolled in our $10,000 skill check program for $99.

Pass his skillcheck assestments

Made $3,516, and $3165 was sent to him based on a 90/10 profit-sharing model.

And his enrollment fee was refunded to him.

This is our prop firm model, and technically, we take 100% of the risk while he takes the rewards.

Are you beginning to see how prop firms can make you rich?

Leverage:

The ability to increase trading possibilities by leveraging the firm’s funds and resources is the fundamental component of prop trading.

Prop traders can scale their holdings and follow tactics that would be unattainable for individual retail traders by utilizing the firm’s cash when trading.

Prop traders can take advantage of short-term opportunities, take advantage of market inefficiencies, and even make significant gains because of their greater purchasing power.

Challenges To Being Rich Through Prop Trading

Although prop trading firms have the potential to generate significant riches for their traders, I must educate you guys on the risks and difficulties that come with trading financial markets.

Proprietary trading poses a distinct set of challenges that, if not handled skillfully, might prevent traders from achieving their financial goals. Some of these challenges are;

1. Uncertainty and Volatility in the Market:

The volatility and unpredictability of the market are one of the major challenges faced in prop trading.

Volatile market moves can be caused by changes in asset values, economic events, and geopolitical developments.

This can result in traders suffering unanticipated losses and drawdowns.

However, you can minimize the damage that this can cause to your capital.

How?

To minimize exposure and protect capital, risk management amid market instability necessitates alertness, flexibility, and a deep comprehension of the market structure.

2. Overleveraging and Excessive Risk-Taking:

This is another challenge that plagues the majority of traders.

The urge to overleverage and take excessive risks is also a barrier to wealth for traders.

Though leverage can increase your profits, it can also increase losses, putting your traders in danger of large losses.

When using leverage, traders must be cautious, ensuring that position sizes match their risk tolerance and following tight risk management guidelines to prevent capital-wrecking losses that could destroy their dreams of becoming wealthy.

3. Psychological Pressures and Emotional Biases:

A variety of psychological pressures and emotional biases may be triggered by prop trading, which may impede traders’ ability to make wise decisions.

Common emotions that can result in impulsive trading decisions, inadequate risk management, and ultimately financial losses are fear, greed, and overconfidence.

Developing a disciplined attitude, engaging in mindfulness practices, and building emotional resilience are crucial for getting beyond psychological obstacles and continuing to take a logical approach to trade in the face of market volatility.

Knowing the challenges that lie ahead of you helps you to avoid the trap that could potentially destroy your dream of becoming rich through pro trading.

Now, let’s discuss how exactly you can become rich through prop trading.

How To Become Rich Through Prop Trading

1. Mastering Market Analysis:

A solid understanding of market analysis is essential for successful prop trading.

To recognize high-probability opportunities for trading and profit from market inefficiencies, traders need to have a thorough understanding of technical approaches.

Traders can increase their chances of success and obtain a competitive edge by developing their analytical abilities and keeping up with market trends.

2. Creating Quality Trading Strategy:

Profitable prop traders depend on stable trading strategies that are customized to their trading preferences and risk profiles.

A disciplined approach to trading that is in keeping with one’s goals and tastes is necessary for traders, regardless of whether they utilize breakout trading methodology, mean-reversion approaches, or trend-following strategies.

In the cutthroat world of prop trading, traders can maximize their performance and increase their chances of success by backtesting and refining their trading tactics over time.

3. Implementing Risk Management:

Long-term success in prop trading depends on how effective your risk management is.

To lessen the effects of market volatility and safeguard cash, traders must set precise position sizing standards, set stop-loss orders, and define risk tolerance.

By putting capital preservation first and limiting exposure to unnecessary risk, traders can protect their cash and set themselves up for long-term success and growth.

4. Building Psychological Resilience:

Prop trading is sometimes a mentally taxing activity that requires traders to deal with erratic, volatile, and emotionally charged situations.

Making logical, disciplined trading judgments and remaining calm in the face of difficulty depends on developing your psychological resilience.

Through the practice of mindfulness, good stress management, and upholding an optimistic outlook, traders can overcome psychological obstacles and prosper in the ever-changing realm of prop trading.

5. Ongoing Learning and Adaptation:

Learning and adapting are constants on the road to financial success through prop trading.

Successful traders adopt a growth mentality, continuously acquiring new information, honing their craft, and adjusting to changing market circumstances.

To stay ahead of the curve and optimize their earning potential, traders must dedicate themselves to lifelong learning and self-improvement, whether through monitoring market trends, attending trading seminars, or picking the brains of seasoned mentors.

Overall, Prop trading is a viable means of achieving financial success for people with the necessary abilities, mindset, and routine.

In the very competitive field of proprietary trading, traders can realize their financial dreams and become rich by simply becoming experts in market analysis, creating a profitable trading strategy, accepting risk, building psychological resilience, and making a commitment to lifelong learning and adaptation.

“Do you want to know what is even better?”

“Do you want to know a shortcut that can help you achieve all these?”

Well, it is the Forex Mastery Course.

Yes, the Forex Mastery course has helped tens and hundreds of students to get rich through prop trading.

Helping them become professional market analysts and have a very good trading strategy that has proven to be right nine out of ten times, among other benefits.

Why don’t you do yourself the favor of purchasing the mastery course so you can achieve your life-long goal of becoming rich through prop trading?

Conclusion:

In conclusion, prop trading companies present determined traders with an encouraging route to prosperity and success, supported by sophisticated technologies, profit-sharing plans, and capital availability.

Prop trading offers huge potential returns for individuals with the necessary skill, strategy, and dedication, but the road to riches is not without its difficulties and risks.