Forex trading has gained popularity in recent years, and it is a potential path to gaining financial freedom, largely due to the success stories of traders portrayed on Instagram.

And that goes by the saying, Can Forex Make You Rich?

Key Takeaways

- Forex trading can lead to financial freedom but requires patience and education.

- Understanding the basics of forex trading is important before starting.

- Successful traders focus on risk management and have a solid trading system.

- Leverage can amplify both profits and losses, so it should be used with a lot of care.

- Learning from experienced mentors and having a proper trading education is very important.

Can Forex make you rich?

As a Forex trader who has over 13 years of trading experience under his belt and has traded for governments in some other countries, I can tell you for a fact that “Yes,” Forex can make you rich, as it depends on various factors that I will uncover soon.

Forex trading as the name implies means Foreign exchange, which simply involves the buying and selling of currencies in the foreign exchange market.

You buy when you anticipate the price of a currency to go bull(up).

You sell a currency pair, when you anticipate a fall in price (bearish).

Due to that, forex traders make a profit whenever their anticipation of a currency plays out as they said.

The forex market is the largest financial market in the world trading with over $7 trillion traded daily, open 24 hours a day, five days a week, which means that traders can trade whenever they want.

And the Good part is it requires relatively little capital to get started.

Not just that, Forex brokers also offer leverage, which means that traders who trade the financial market can control large positions with a small amount of capital.

For instance, if a broker offers a leverage ratio of 100:1, a forex trader can control $10,000 worth of currency with only $100 in their account or position size.

That is what makes trading superior to other forms of investments.

All these may sound enticing but it is crucial to note that trading with leverage can be risky as well, as it can amplify both a trader’s profits and losses.

Most retail traders or beginner traders who are new to forex trading often make the mistake of using too many leverages in a trade, which can quickly wipe out their trading accounts if the trade goes wrong.

As a trader looking to be profitable in this game, it is essential to have a sound trading system and ensure your risk management plan is in place before trading currencies with a live account.

When it comes to forex trading in the financial market, some traders have built a fortune out of this just by clicking buy and sell.

George Soros is a prime example of a successful trader who has gained notoriety for his trading prowess.

He is renowned for his trading ability and has made over $1 billion in a single day by shorting the British pound in 1992.

His dedication to trading has put him in the spotlight as one of the most successful traders of all time.

Goerge Soros is not alone on this, Andy Krieger is one of a kind as well.

He made $300 million by simply shorting the New Zealand dollar in 1987.

However, it is essential to note that these traders are the exception rather than the norm.

Now back to the question

How Forex Trading Make Me Wealthy?

As a living witness, I can attest to the fact that forex trading has the potential to make you rich.

It has been a life-changing experience for me, as I made my first million dollars through forex trading.

However, it’s important to note that while the financial markets have produced many millionaires, it has also left some traders back to scratch.

The question is, what differentiates successful millionaires from those who struggle to make a living trading forex?

The answer lies in getting the right education and having a solid trading system.

If you are wondering whether forex trading can make you rich, I am glad to announce that it is 100% possible with hard work.

I am living proof and a full-time forex trader.

How did it happen?

It all begins with the next paragraphs.

A Sneak Peak Into My Background Story

My name is Dapo Willis, and I have been a trader and investor in the industry for 12 years.

I began trading when I was just 17 years old and have since made my first million dollars through trading.

Forex has transformed me from a college student,

To an all-time multi-million dollar individual today.

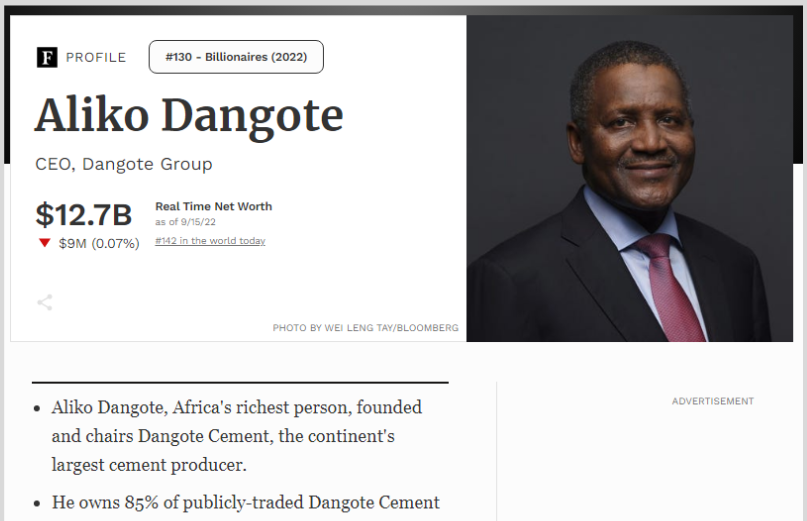

Through my success, I have gained the attention of many wealthy investors, including African billionaire Aliko Dangote, whom I trade and manage funds for.

However, it’s important to note that my success didn’t happen overnight.

I can explain Using My Trading Journey as a Case Study.

After all, if you want to be successful in a particular field, you need to learn from someone who has passed through that same journey to avoid making mistakes that may cost you years to recover.

You can check out my story in the Video version below

How It Started

My interest in trading began when I was 17, after watching “The Wolf of Wall Street” and is inspired by Jordan Belfort’s success as a stockbroker.

I thought forex trading was just another form of gambling putting me upset for unrealistic goals.

Initially, I began my journey trading stocks, but after discovering forex in 2012, I transitioned to it and spent the next several years perfecting my skills in the forex market under the guidance of a mentor.

Before my mentor, the past 4 unprofitable years of my trading career were a complete disaster.

Tested over 20+ trading strategies and 150+ indicators and still find those years of my trading unprofitable.

Thanks to my mentor, who also happens to be a hedge fund manager, I learned everything I needed to know to succeed in this field, including the importance of having a trading edge.

But that’s not all – mastering price action and conducting top-down analysis was the real turning point for me.

However, despite making some money, I still struggled to sustain my external life.

Why? Because you need money to make money in trading, this was way back in 2014 and 2015 when there were no prop firms companies available at that time.

This was a big issue for retail forex traders who found themselves profitable but their returns could not sustain their external life and they needed access to large capital.

Negative thoughts and outside advice began to weigh on me, causing me to lose interest in trading and invest in other businesses instead.

This lack of focus and divided attention led me to become flat-broke and depressed.

However, with the encouragement of my mother and girlfriend, I was able to regain my momentum and return to trading.

I called myself to order and focused solely on forex trading, which eventually led to my success.

In a stroke of luck, I discovered that I had $1,100 in one of my accounts that I was unaware of during my period of financial struggle.

I now had a $1,100 account to trade with.

Wondering how I turned $1,100 into my current position? Let me explain.

Firstly, it’s important to note that I didn’t grow my account from $1,100 to $1,000,000.

Instead, I withdrew my funds to start afresh.

Once I had a new trading account, I analyzed GBPUSD and anticipated a potential 500 drop.

However, I exercised patience and waited for the right time to trade.

One important quality every trader should possess is patience. The market will always obey you if you abide by your rules. this is something that took me years of experience to learn.

I had already done my top-down analysis, which I teach in my Forex mastery course.

It took about a month for the market to show signs of the anticipated drop.

If I had traded earlier during the consolidation period, I would have lost my account.

So I waited for four to five weeks before starting trading.

A trending market phase makes it easier to trade and earn good profits.

Remember, if you want to “flip” your small trading account, the market must be trending, or you risk the market flipping you.

Then I trade based on these moves in the market.

This massive drop only took less than 2 trades and took my account from my initial $1,100 trading account to $5,000 in a space of 3 months.

I did not stop there, I grew it from $5,000 to $7,500 in another 3 weeks.

I was already documenting my trades with myfxbook and that was where the Game changer happened.

Since I was in a trending market, I was making money easily and also keeping track of my trades.

So I approached my first-ever investor who happened to be a billionaire at that time.

Am sorry I wouldn’t want to fill this content with more stories, but luckily you have a video that talks about my experience with a billionaire and those things I said to him that made him invested in my trading.

And that was how my first ever million was made.

How My First Million Dollars Was Made

Over the past few years of trading, I came to realize that the most proficient way to make millions from forex is in two ways.

- Soliciting for investors

- Get funded by a Prop firm

I can explain

Guys, to make millions you need to think like millionaires and billionaires.

And how do they think, they leverage all by “compounding returns”

For example,

For every $1 you put in and you get $2 back,

Put in $100 you get back $200

$1000 you get back $2000

This is the right approach to kick things off.

Note: In these forex industries, you can’t get rich trading from your bank account capital

You can’t turn a $1,000 account size into a $100,000 account size.

In forex, The larger your capital the more returns you get per successful trade.

In other words, the larger your capitals the larger your returns.

With a risk-to-reward ratio of 3:10 Meaning, we are to risk 3% to make 10% per each traded lot (open position).

Risking $30 to make $100 in a $1000 account size. So we trade less often to make more.

So we are to make sure we pick the best possible trades, and for every 5 successful trades in a month,

then we make a return of 500% returns of investment ($5000).

Let’s do the calculation

for every 5 successful trades in a month, you made returns of 500% which is $5000……

- 500% returns of investment with $1000, which is ($5000).

- 500% returns of investment of $10,000, which is ($50,000).

- 500% returns of investment of $100,000, which is ($500,000).

- 500% returns of investment of $500,000, which is ($2,500,000).

The higher the capital the larger the risks and your returns on investments

Guys, no investment vehicle can give you such fantastic returns in a month, even the billionaire folks make 20% annual returns.

So to get large funds, approach investors or any prop firms’ service.

My Candid Advice to Anyone Who Wants to Build A Fortune With Forex

Seeking good knowledge and having a proper trading education are both crucial to your trading success in trading.

Seeking good knowledge simply involves your research and also learning as much as you can about the market, trading strategies, and other relevant information that can contribute to your trading success.

This may involve reading books, articles, and blogs, watching videos, attending webinars or seminars, and talking to other successful traders.

On the other hand, having a proper trading education is a more structured approach to learning.

It may involve taking courses from successful traders, where you get to learn the strategies and other information that can shorten your learning curve and increase the chance of you becoming more successful.

Search for an experienced Mentor:

I have been trading the market for about 12 years now and I can tell you that the mistakes your mentor made would be ones you would learn from and grow fast in the industry.

Make sure to have a job other than trading:

By doing this you wouldn’t be pressured to trade more than usual.

You would also, be able to gather enough capital to fund your trading account and mostly avoid demo trading.

because there are no emotional attachments to a demo account and you need to experience such to be able to learn how to tackle them when trading for yourself.

Do not give negative thoughts a chance in your mind:

Do you remember that it was the negative thoughts I allowed in my mind that made me go back to being a broker trader?

Search for an experienced Mentor:

I have been trading the market for about 12 years now and I can tell you that the mistakes your mentor made would be ones you would learn from and grow fast in the industry.

Make sure to have a job other than trading:

By doing this, you wouldn’t be pressured to trade more than usual.

You would also be able to gather enough capital to fund your trading account and mostly avoid demo trading.

Because there are no emotional attachments to a demo account, and you need to experience such to be able to learn how to tackle them when trading for yourself.

Start with Small accounts:

When you are easy to trade, make sure to start small.

By doing this you would build the capacity to be able to make you control yourself and your emotions, also you would avoid unnecessary losses.

Never Borrow Money to Trade:

Never try to borrow money to trade. because you may end up losing all the borrowed money and further damaging your finances.

Always Journal your Trade:

You see it was my already journaled trades that helped me to be able to smash the market and made a lot of money for me.

You can purchase prop firm accounts:

After you have had a well-defined strategy, you can go ahead to purchase a prop firm account as they give you access to larger funds.

Remember to grow your account as you make money from these prop firms.

With my experience shared,

I hope you have learned a lot, and rather than spending 3 or 4 years or even more learning forex, you will be able to find better means to trade.

Is Forex Trading a Good Career Choice?

Forex trading is a Good career choice for those who have a deep understanding of the markets and the technical skill sets to analyze and make profitable trading decisions.

But it not going to come easy, you can only achieve that with dedication, and proper education.

Successful traders need to have the resilience to be able to handle losses and the ability to maintain a healthy work-life balance.

It is important to be realistic about the risks and challenges involved and to have a backup plan in case things don’t go as planned.

Can trading forex make you a billionaire?

Forex can make you a billionaire when practiced with proper education.

To reach billionaire status in trading, it is essential to comprehend the principles of compounding returns and hedge fund management.

The likes of George Soros, who made it to the top of the forex market, attained this feat by mastering the techniques of compound interest and managing a hedge fund.

Can I make Forex a full-time job?

Forex can be a full-time job only when you are a profitable trader, with that you can quit your 9 to 5 job for trading full-time.

if you are not profitable yet don’t venture into being a full-time trader.

Over To You?

What did you learn from today’s story?

Are you doubting, that you cant become a Forex millionaire

Either, I would love to hear from you in the comments.

Learn More: How Long Does It Usually Take To become a Millionaire by trading forex?