I have been trading for 12 years and the first 3 years of my trading was a complete disaster.

Why?

Because I made some “Horrible mistakes” that cost me years of my trading career

…and won’t blame me, if only I could see someone who could simplify things for me.

These mistakes are practical things that traders who focus rely Heavily on price action fall into these traps.

Even experienced traders are guilty of this approach.

To save you my wasted efforts and time, I have compiled all of them in one piece, which is today’s post.

To save you from making the same efforts and wasting time as I did, I’ve put together all these mistakes in today’s post.

Key Takeaways

- Complicated analysis can impede your trading success; in my experience, simpler charts are more effective.

- Always identify and focus on key levels like support and resistance to improve trading decisions.

- Avoid overtrading; patience is very important for you in order to spot high-probability setups.

- Trading at support/resistance levels can be risky; in my experience, I advise traders to wait for clear breakout signals.

- Emotional trading leads to poor decisions ensure you follow a strict trading plan.

But believe me, you won’t easily find these mistakes on the internet.

It takes a lot of practice and keep at it to actually figure out how to fix them.

Keep Reading…….

Problem 1: Overcomplication Of Analysis

The first difficulty is that it is too hard to figure out what is going on.

One of the most common mistakes traders make when using price action as a trading approach is making the analysis too complicated.

In fact, I used to make these mistakes years ago and my trading never seems to get better.

Back in the day, my charts used to look somehow like this…….

I was looking out for indicator patterns, confirmations patterns, trendlines patterns, and lots more that my charts gets too complicated.

Not Bad…..but flooding my charts with a lot more distractions…

When there are a lot of signs and charts, it’s easy to get confused and unsure of what to do, but it might lead to bad things.

In the reality of trading, less is more…

Traders often try to use too many indicators or look for too many patterns, which can lead to mixed signals.

Solution: Simplicity Is The Best Solution

The best way to deal with this difficulty is to keep things as simple as possible.

Pay attention to the most important indicators and price action patterns that have led to good outcomes in the past.

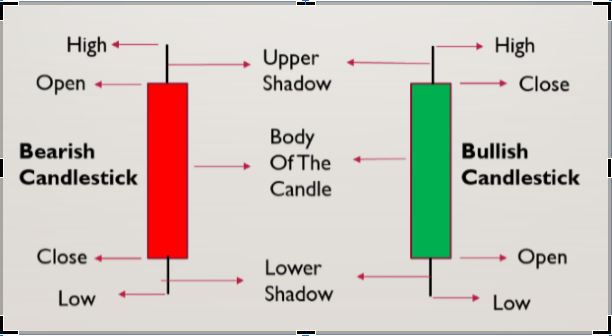

Traders could use tools like candlestick patterns.

Support and resistance levels

And trend lines.

Fibonacci Retracements for confirmations.

Also, you shouldn’t try to look at a lot of different periods at the same time. Instead, you should focus on just one or two.

Problem 2: Identification Of Key Levels

Failure to notice major levels is another common issue that can be developed when trading solely on price action.

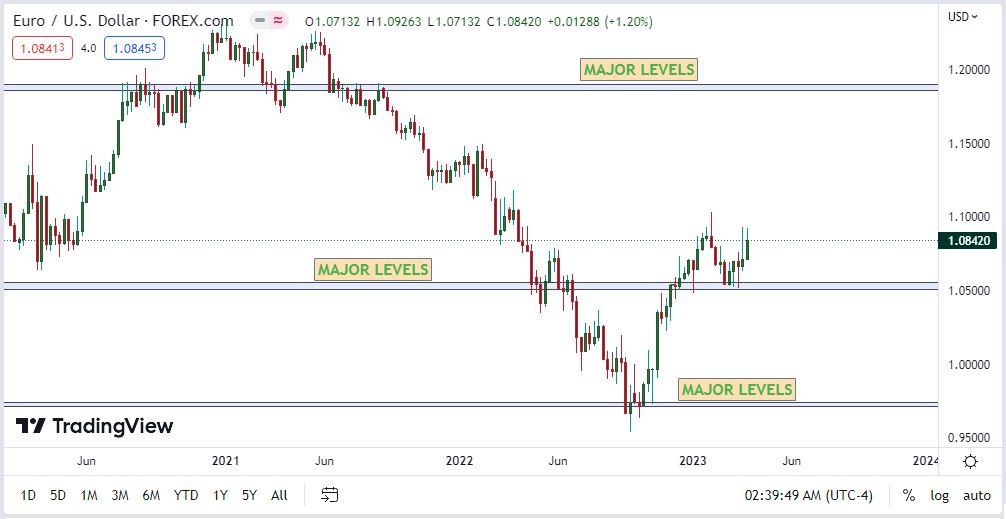

What are these levels? major levels can be support and resistance levels.

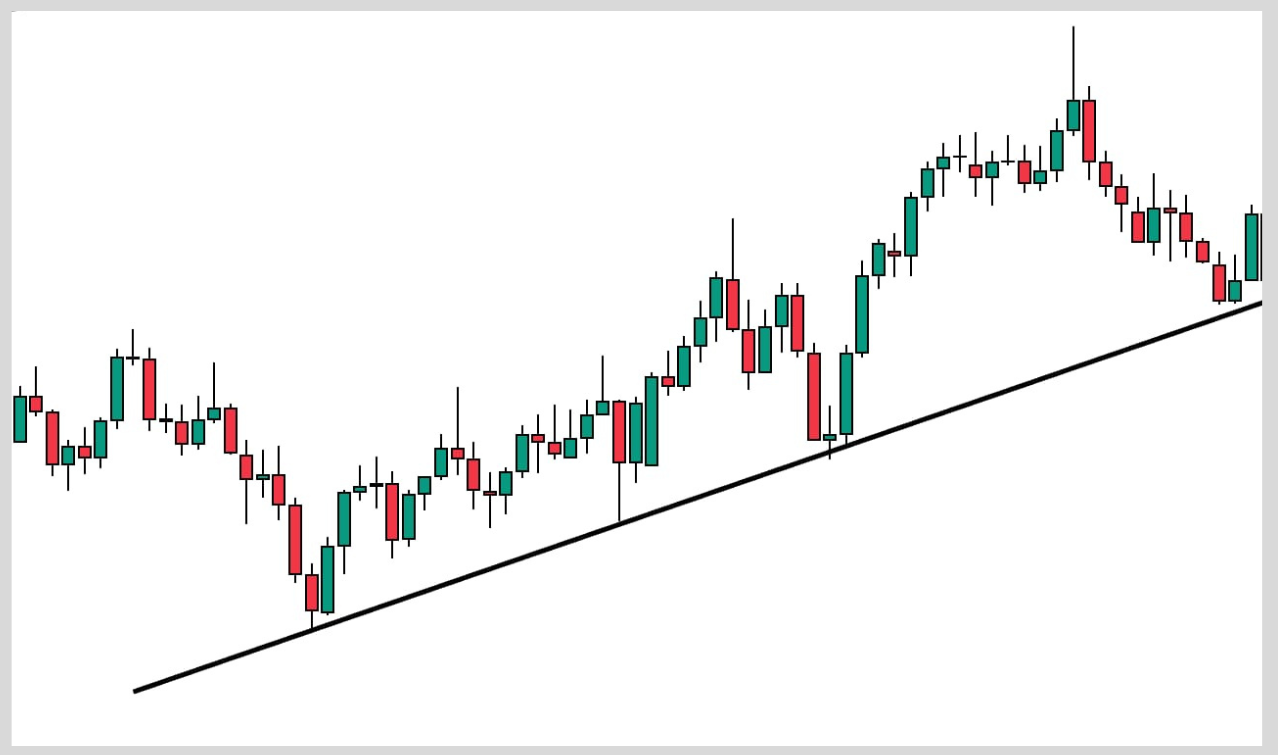

Trend line acting as support

Or Trendline acting as resistance

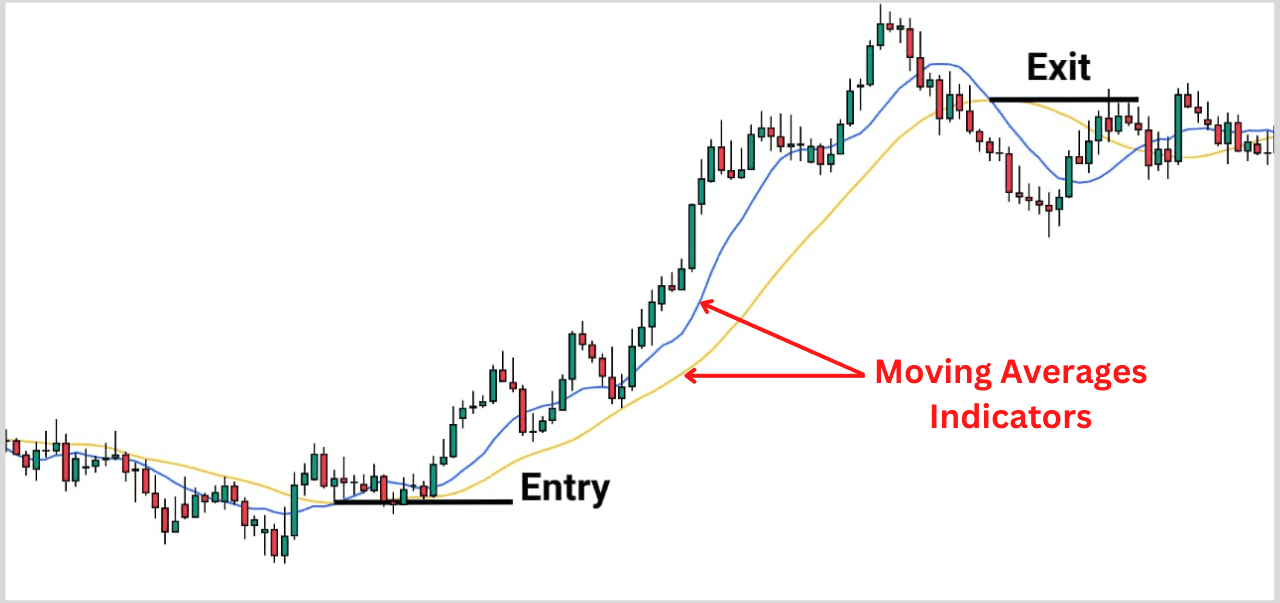

And moving averages.

Just so you know, I’m not really into using indicators.

I mainly focus on watching how prices move, and this approach helps me win about 90% of the time (you can learn more about this).

Now back to the story…

Traders who can’t spot these levels could miss out on the following changes that yield profitability…

- Potential trend reversal

- Breakout or reversal

- Entry points and exit points etc

Solution: Plot Accurate Key Levels

To avoid missing out on these huge potential benefits, price action traders should focus on finding important levels on the charts where the price could potentially react to.

To do this, you can utilize the use of technical indicators to find levels of support and resistance, or you can look for regions where prices have moved in the past.

Learn more: How to plot Key Levels or Support and Resistance

Once these levels are known, traders can use them to make more informed decisions regarding the market.

Problem 3: Overtrading

Patience is a virtue, and it took me many years of my trading journey before I could adhere to it.

To have a win rate of 7 out of 10 times in the market, you need a high-probability setup.

A strategy helps you look out for trading opportunities, but patience exposes you to more opportunities.

As a trader who wants to be right 7 out of 10 times, you must understand that the market is full of ups and downs, session by session, volatility, non-volatility, and more.

With all these fluctuations in the market, it requires a high level of patience for the price to provide you with a high-probability setup that keeps you consistently right.

That’s one reason traders with the best strategy still lose because they’re not patient enough for the price to form the appropriate setup that aligns with their strategy.

If you don’t learn how to be patient enough and be well disciplined, then the market will teach you the hard way.

And once that happens, you’ll keep paying your broker bills until you learn to be patient enough.

Traders who use price action trading may also face the problem of trading too often.

This tendency can cause traders to place too many trades, which can result in significant losses because each trade requires undivided attention.

The less trade you focus on the better your chances of success will be in the financial market.

Solution: Wait for High Probability Setups

Focus on High Probability Setups that meet your trading criteria, you can increase your profitability and reduce your risk of losses.

Therefore, it’s important to adopt a disciplined approach and trade only when the market conditions align with your trading strategy.

Remember, it’s not the number of trades you make, but the quality of trades that matters in the long run.

To reach this goal, you can either wait for a clear breakout and retest.

A strong trend

a massive candlestick formation, or any other extra confirmation signals that qualify a setup.

Problem 4: Trading At Support/Resistance Areas

Take a look at these scenarios.

Price tested this resistance level and was unable to break these resistance zones, as shown below.

Basic Price Action 101: The more price test or rejects a level, the more significant it is.

Imagine you had placed your sell entry at the candlestick rejection of that resistance level since the price once rejected that level twice in the past.

You would have been in profits if you traded based on that.

Of course not….

But experience-wise, this is not how you should get into a trade, especially at the resistance or support level.

And I won’t blame traders who trade like this because that’s how Babypips taught you.

Most traders are usually looking to get the best possible price early, so they try to get into a trade as soon as they notice some candlestick rejections.

This approach will only land you in profit for a few trades.

It is only a matter of time before you realize you are always getting blunt.

The reason is that the price usually tends to break at the support or resistance level 80% of the time.

But before doing that, Price always gives a sign…

It’s left to the trader to use these signs and make better trading decisions.

In most cases, the price hit your stop loss before heading in your direction as anticipated (Learn More).

In conclusion, avoid getting into a trade at the support or resistance levels.

What should you do instead? Either wait for a breakout and retest.

Or use the counter-trend strategy to get into a trade.

Problem 5: Emotional Trading

Traders run the risk of making irrational trading decisions and losing money if they allow their emotions to influence their choices in the market.

Solution: Learn to Master Your Emotions

Understanding Market Psychology Using Price Action.

It’s essential to learn how to keep emotions in check by developing a trading plan and sticking to it.

By following a set of predefined rules according to your trade plan, you can identify high-quality trades and avoid making hasty decisions.

For instance, I only get into a trade when the following conditions are met.

- When the market is trending

- When the price retests a certain level from the point of entry, or a candle closes below or above my counter trend line.

- My risk to reward per trade

With these rules set in place, you can justify potential moves in the market based on your trading plan.

- When not to enter a trade

- When prices may potentially go against these rules set in place

- My Risk to reward to avoid over-leveraging

By adhering to these rules, traders can boost their confidence and track the success rate of their trading strategy.

Ultimately, having a trading plan in place is crucial to justify potential moves in the market and make informed trading decisions based on a solid strategy.

With all these rules put in place, I only justify my analysis based on my trading plan, nothing else.

Conclusion

Price action trading is a typical trading strategy that, when implemented effectively, has the potential to be tremendously profitable.

Traders who use this strategy, however, risk several problems, such as making the analysis too complicated, missing important levels, trading too often, putting too much emphasis on entry and exit points, and letting their emotions affect their trading decisions.

Traders may avoid these problems and make more money from price action trading if they use the solutions that have been presented above.