In the realm of Finance, we often refer to investment opportunities, and one avenue that has garnered significant attention over the years is Forex trading.

Foreign Exchange (Forex) trading involves the buying and selling of currencies with the aim of making profits from fluctuations in their exchange rates.

When you anticipate the price of a currency to rise, you make a profit if the price moves as you predicted, which is known as an upward trendline.

Likewise, if you anticipate and correctly predict a currency’s decline in value, you can make money from the downward trend.

Unlike traditional stock trading, where you aim to buy low and sell high, or cryptocurrency investments where you buy and hold for the long term, Forex trading allows you to profit from both rising and falling currency values.

The intriguing aspect of Forex is that it doesn’t demand any specific level of education or prior financial experience in investing.

People ranging from novices, with little to no knowledge of the Forex market, to experts who are well-versed and experienced, can all participate in Forex trading.

You also don’t need to read financial reports every day to become a successful trader; it is not a necessity.

Knowing full well that Forex trading can be highly rewarding, it also carries inherent risks that require careful evaluation before determining if it’s a suitable addition to your investment portfolio.

With all these benefits…………

Does that make Forex A Good Investment?

Forex trading can be a good investment and an attractive addition to an investment portfolio, because of the potential opportunities for profits and diversification.

While Forex indeed holds promise for profits, it also carries a high level of risk, much like any other form of investment.

Successful traders, however, prioritize understanding and managing these risks effectively, because there is no investment that doesn’t involve some degree of risk.

Consider this scenario to illustrate this concept:

Suppose you placed 10 trades with a risk-to-reward ratio of 3:10, meaning you risk $30 to potentially gain $100 per trade on a $1000 equity.

One loss results in -$30

One win leads to profits of +10%, which is $100

Even if you encounter 6 losses and only 4 wins, you can still come out with profits:

6 losses amount to: -$30 + -$30 + -$30 + -$30 + -$30 + -$30 = -$180

4 wins sum up to: +$100 + $100 + $100 + $100 = +$400

Total ROI: +$400 – $180 = +$220 in profits

The results? Risk small win big.

This is not rocket science but rather the principle of the risk-to-reward ratio, a proven trading methodology that favors positive outcomes because the forex market is a game of probabilities.

Successful forex traders who have built substantial wealth understand and leverage this concept, allowing them to build multimillion-dollar forex empires, such as hedge funds.

This is what makes Forex a nice addition to an investment portfolio.

The returns on your forex investments are influenced by factors such as:

- Experience with the market

- Trading Methodology

- Mindset to trading

- Patience

I can Explain

Experience Is Your Best Teacher:

Learning from a successful mentor can undoubtedly save you years of failure and accelerate your learning process. However, it’s essential to recognize that success is not solely guaranteed by this mentorship.

True success in any field comes from taking action based on what you learn.

While having a mentor can be tremendously beneficial, it is not a guarantee of success.

Throughout your journey, you may encounter challenging situations where your mentor won’t always be there to assist you.

These moments will require you to face and overcome difficulties on your own, leading to valuable experiences and growth.

Building traits like dedication, discipline, and focus takes time and effort.

These qualities cannot be developed overnight; they require significant experiences and learning from both successes and setbacks.

This is what makes trading more of a “get-rich-slow scheme” that rewards those who consistently work hard and learn from their experiences.

It’s essential to understand that there are certain aspects of trading that a mentor cannot teach you, such as handling fear.

Overcoming fears and managing emotions is something you have to navigate and learn to control on your own. While a mentor can provide guidance, the journey toward success ultimately relies on your actions and decisions.

A Proven Trading Methodology:

The forex market is constantly changing and influenced by various factors, making it challenging for traders to predict its movements with certainty.

Instead of determining the market’s direction, traders often focus on anticipating the price’s next move.

This anticipation is based on probabilities, which are evaluated using price history.

Traders use the basic laws of price action to analyze past market behavior and make trading decisions accordingly.

The adage “history always repeats itself” holds true in the forex market, as price tends to form recognizable patterns on a recurring basis.

For example, the head and shoulders pattern is one such formation.

When this pattern appears and the price breaks below the neckline, it often indicates a bearish trend, providing an opportunity for traders to go short.

However, while such patterns can present high-probability setups, they should be confirmed with other factors before entering a trade.

Trading decisions should not be solely based on pattern recognition but also consider other technical indicators, market sentiment, and fundamental analysis for greater confirmation.

In conclusion, traders use their own trading methodologies to take advantage of recurring price patterns like the head and shoulders, but it’s essential to exercise caution and consider multiple factors for a more comprehensive analysis before executing a trade.

The forex market’s dynamic nature necessitates a well-informed and adaptable approach to trading.

Mindset to Trading:

You probably come across trading profits like this from traders on social media.

This triggers your mindsets and is one of the reasons why you want to become a forex trader as it’s the shortest path to financial freedom.

Truth be told, forex can be the shortest path to financial freedom only when practiced with proper education.

But the question is How short is it? it takes years of consistency.

So what you see on social media are someone years of consistency, failures, and pains.

So whenever you come across such posts don’t treat them as motivation to keep improving and to focus on your own journey of growth as a trader.

Embrace the learning process, seek proper education, and be patient in developing your skills.

Patience:

The most successful traders are those who wait rather than trade meaning they do not have to spend all their time on the charts.

You need to understand that the market doesn’t trend all the time, so there is a need to potentially wait so as to enable you to find the best setups that aligns with your trading goal and methodology.

The longer, the better.

#1 Forex Investments: The Hedge Funds Management

Forex is an investment for traders that has what it takes to become successful.

I have studied five successful traders who took trading as a full-time income and came to realize one thing, they are all hedge fund managers.

The key to their extraordinary achievements lies in the concept of compounding returns, which has led them to establish Hedge Fund Management Companies.

In this approach, they utilize investors’ capital to trade and split profits, capitalizing on the power of compounding returns.

I previously explained the significance of the risk-to-reward ratio, highlighting the total ROI from a $1,000 equity trade, which resulted in a profit of $220.

This translates to a 22% return on investment for the initial equity of $1,000.

- 22% of $10,000 equity is $2000.

- 22% of $100,000 equity is $22,000

- 22% of $1000,000 equity is $2000,000

What does this tell you?

The same returns on $1000 equity can make a difference in $1000,000 trading size.

So you do not need a trading methodology that can make you 100% ROI which is unrealistic unless you are exposing your account to more risk.

Hedge funds serve as excellent examples of this strategy in action.

While they do not provide capital themselves, they trade on behalf of investors, leveraging the power of compounding returns to generate substantial profits, which has been the source of my own success as a forex trader, yielding over $150 million.

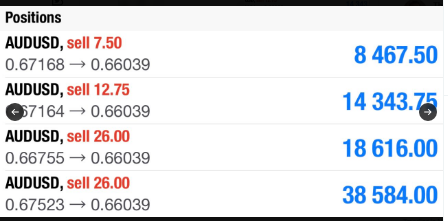

#2 Forex Investments: Prop-Firm Trading

One of the downsides of previous forex investments is the need to seek funds from external investors, which involves convincing them to trade with you.

While this approach can be effective, it may prove challenging for individuals who are introverted or lack access to wealthy investors.

In such cases, proprietary trading firms (prop firms) offer a solution.

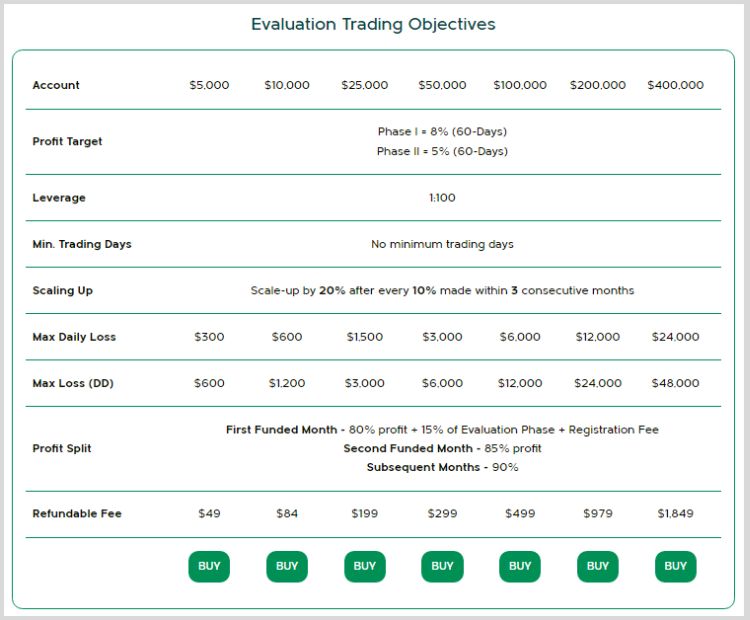

Prop firms are companies that provide traders with capital of up to $400,000 to trade with for a fee.

The process is relatively straightforward: traders need to demonstrate their profitability by passing a trial, and upon successful completion, they receive funding for a live trading account based on their budget.

This arrangement benefits both the traders and the prop firm companies.

Traders gain access to substantial capital without the need to solicit funds from external investors, while prop firms profit from the fees charged and the shared profits with the traders.

Once profits are made from trading with the funded account, the profits are split between the trader and the prop firm.

The typical arrangement involves the prop firm keeping up to 10% of the profits, while the trader retains the remaining 90%.

In summary, prop-firm trading offers an attractive investment option for traders who seek access to significant trading capital without the challenges of finding external investors.

The arrangement allows traders to focus on proving their profitability through a trial, and once funded, they share their trading profits with the prop firm under a mutually beneficial agreement.

Learn More: Prop Firm Statistics That Will Blow Your Mind

So, Is Forex Trading A Good Investment?

For us to answer this question properly, we have to look at the main characteristics of what is considered a good investment.

The following are the characteristics of a good investment;

The expectation of a return: When you invest your money, the main goal is to see it grow! That’s right, we’re all looking for some sweet returns on our investments.

Inherent risk: Now, hold on tight because every investment comes with a little bit of risk. But you know what they say, “no risk, no reward!” Just be smart about it and do your research.

Liquidity: Picture this – you want to trade or cash out your investment. Well, it’s awesome when that’s super easy, right? That’s what we call liquidity – the ability to turn your investment into cash without too much hassle.

Stability of income: Who doesn’t love a steady stream of income? When your investment provides you with a consistent flow of cash, that’s some real financial comfort.

The question now is, does forex have all these characteristics?

The answer is, when traded properly Forex easily fits in and therefore forex can be considered a good investment.

Making Forex A Good Investment

If you want to make forex a good investment, you treat it like a business.

Just like the way it takes hard work, patience, very good strategy, and realistic short-term and long-term goal to succeed in any business, it takes the same to make forex a good investment.

As you know in business, not every season is for profit making, you have to embrace the inherent losses that come with forex trading.

Every trader’s goal is to make sure their profit is more than their loss.

If treated rightly, forex trading can be a very rewarding venture to go into.

If you want to know the mistakes of traders and how to avoid them, read this article.