In today’s post, I’m going to show you a “Trading methodology” on how to grow a small Forex trading account.

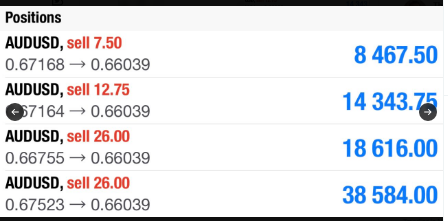

The Good Part is that this trading methodology I’m about to share helped me grow my small forex trading account to over $80,000 in profits.

I share that on my Twitter handle.

I’m not a fan of posting trading profits because I feel it’s very amateur.

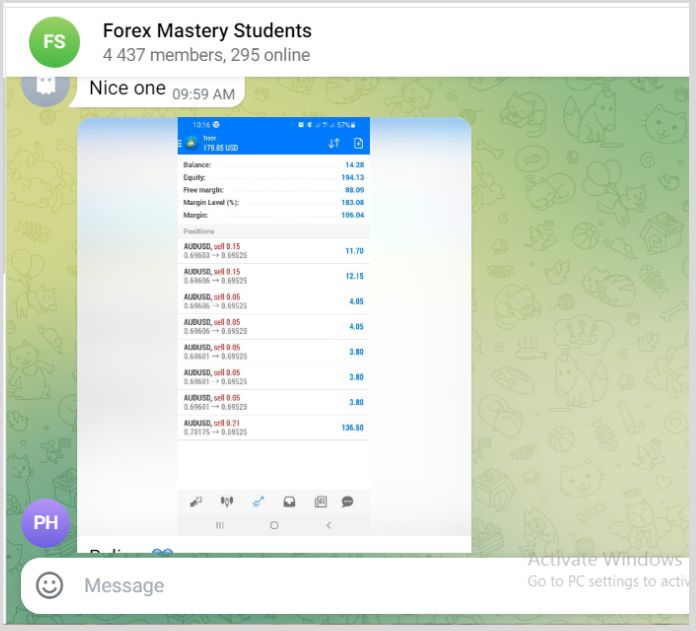

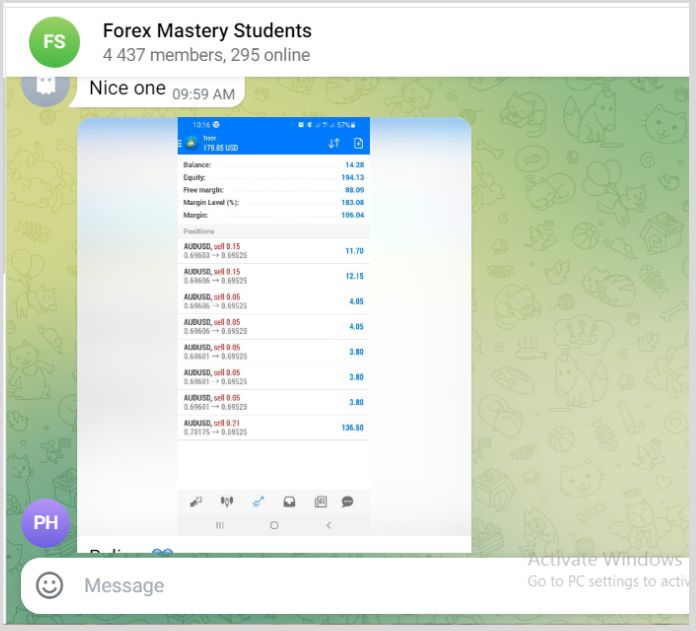

However these are my AUDUSD entries on my smaller account.

Been holding across all my personal and investors account since the 3rd of march. pic.twitter.com/TnWCGy0hNS

— Dapo Willis (@IamDapo) April 26, 2023

If $80,000 doesn’t look like a small account to you.

Then, look at one of my students who “deployed this trading methodology” and made 1178.57% ROI on a $14 forex trading account

The interesting part is that it works on any financial instrument.

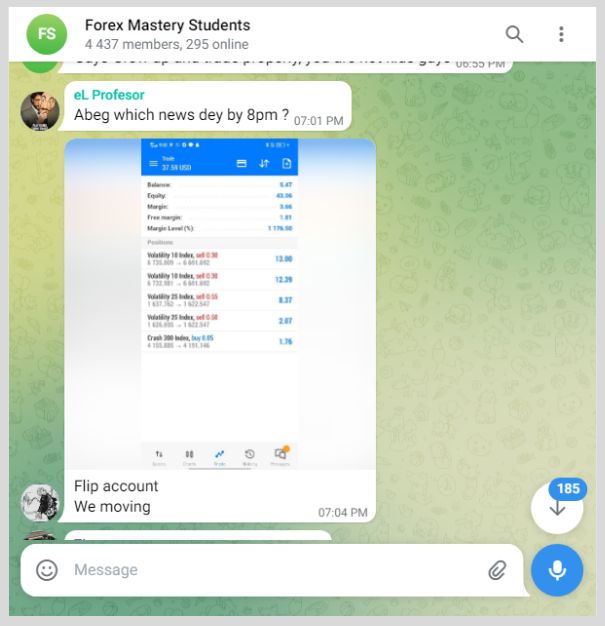

Just like this student of mine who grew his small account trading synthetics by 640%.

And that’s because the trading methodology works for any small account sizes and financial instruments.

I made a video version of this post below.

Either way, let’s get started.

Key Takeaways

- It’s easier to flip a small account in a trending market

- Be patient for the best trade setups

- Stack your trades in the direction of the trending markets

- Seek education from experienced traders.

- Trending markets help you simplify entry and exit points.

- Losses are part of the learning process.

- You need to stick to the laid-down strategy for long-term success.

Scaling Up With Willis Capitals:

As someone who’s been trading for over 13 years, here’s a tip:

Growing a small forex account quickly might seem exciting, but it’s not a sustainable approach because it exposes you to too much risk.

Let’s say you’re growing a $10 forex account.

It might seem tempting to risk as much as 50% per trade to see significant gains.

But with such high risk, just a couple of 2 bad trades would wipe out your account entirely.

And I understand how tough it can be to fund your trading account after such a setback.

That’s why I’ve launched my own Prop firm, Wfunded.

We provide trading capital to help you succeed.

Recently, one of our traders earned $3,165 in profits with Zero risk and Good ROI, showing the potential of our approach.

How To Grow A Small Forex Account + Case Study:

Have you ever wondered how “easy” it is to grow a small trading account by “640%”

Well, it’s not as “easy” as it might sound.

Achieving this kind of growth requires a certain skill set.

To put it in perspective, 640% of $1000 is just $6400.

This is 100% possible by simply trading just one “pair” or a “few pairs” because less is more.

Don’t be misled by the idea that you need to trade all available markets before you need to grow or be able to flip your small account within the shortest time possible.

And trust me, this is a big Misconception:

What do you need instead?

A few high-probability setups in conjunction with the following checklists:

- A proven trading strategy

- Sticking to a Risk management rule

- Trade “only” in trending markets

I can explain:

Sticking to a Risk Management rule:

To be able to flip and grow your small forex trading account in the shortest time possible, you need to risk big to win big.

How big?

I can explain:

If you follow the traditional risk management plan (risk 1%-3% to make 10%)

- 1% of $1000= $10

- 3% of $1000= $30

It is going to take you 100 trades to meet 100% ROI and 600+ Trades for 640% ROI (neglecting losses for simplicity)

We don’t want this…..

So the question is, how do we achieve the same results in the shortest time possible?

By increasing your risk to 20%

Is this the perfect Risk management formula for flipping accounts?

No…but a head start to scale up faster.

Risk 20% to make 100%

You’re only just 5-6 successful trades from meeting the ($6400) target:

Now ask yourself, what’s the probability of you making at least?

- 4 successful trades out of 5

- 3 successful trades out of 5

If you can’t guarantee this probability of meeting with at least the following, then you may end up getting beaten by the markets…

The thing about high-probability trades is that they often take a considerable amount of time to develop, and they demand patience from you as a trader.

So, when these opportunities do finally materialize, it’s essential to stack the odds in your favor and seize the trade.

And it all comes back to having a proven trading methodology:..

Want to learn more about my Trading methodology

I made a free 30-minute training to walk you through this process: Learn More

Identify Market Trends:

Market trends show which way prices are moving.

Is the market going up?

Or down?

Following the trend is good because you’ll lose fewer trades when you trade in the same direction as the market.

In this Case:

AUDUSD is forming Lower highs and lower lows, which is a characteristic of downtrend markets.

Next-level targets of price as shown above.

And that leads us to the next section.

Performing Top-Down Analysis:

The top-down analysis approach is a straightforward process.

It simply means analyzing the market from a higher time frame and then identifying the market direction to execute in lower time frames based on the direction of the higher time frames.

In other words, the higher timeframes paint the bigger picture.

It gives you the direction of price movements over a long period.

This approach proved to have made me a profitable trader.

Recall the $80,000 profits I showed earlier in this post. The top-down analysis technique made it possible.

I taught my students the same concepts, and the results speak for themselves.

And it all started like this.

I plotted key levels on the higher time frames, such as the monthly and weekly time frames.

I noticed that the market was in a clear downtrend direction, characterized by lower highs and lower lows.

Based on today’s case study:

I expected further lower lows in the coming weeks.

This is a 1000 pip drop in AUDUSD already anticipated.

The price moved as anticipated, and that leads to the screenshots below.

Sniper Entry & Exit Points:

Based on the AUDUSD case study, I was able to determine that the trade direction was sell, which allowed me to focus solely on potential selling opportunities in lower timeframes.

Holding on to my sellers.

I plotted a counter-trendline on Daily TF.

NOTE: The counter-trendline break is my favorite entry and exit point.

They also serve as a safeguard against market manipulations and save me from falling into premature trades.

Now back to the AUDUSD case study.

Waited for a break in the counter trendline.

Placed my sell trade.

Went on timeframe Lower to find possible entries as shown.

Currently stacking on that trade as well.

That was how I was able to achieve that.

Getting The Right Education:

If you overlook this part of your trading strategy, achieving your goal of becoming a successful forex trader will remain just a dream, far from reality.

Enough dreaming; it’s time to take action.

Success in forex trading is all about having the proper education.

And that education goes beyond simply applying the trading methods I discussed earlier.

You require:

- Discipline: Sticking to your trading plan and strategies.

- Knowing when to trade and when to hold back.

- Identifying high-probability trading setups.

- Understanding the psychological aspects of trading, such as managing emotions and staying focused under pressure.

Chart Time:

Merely obtaining the best Forex trading course does not guarantee immediate success in growing your small trading account.

It requires extensive chart time and practice to apply the knowledge you have gained effectively.

This process takes not just days, but several weeks of consistent effort.

The more you familiarize yourself with various price patterns, the more comfortable you become in recognizing trading signals.

It is crucial to practice and become accustomed to the concepts you have learned so that you can make informed trading decisions based on the knowledge you have acquired.

With enough practice, you will develop the ability to quickly identify market signals through price action, allowing you to place trades with confidence.

It takes time and effort to gain proficiency in Forex trading, and consistent practice is essential to enhance your skills and increase your chances of success.

Remember, it’s not just about acquiring knowledge, but also applying that knowledge through practice in real trading scenarios.

Consistency:

One of the crucial components of a successful trading career is consistency.

It’s a well-known fact that the Forex market evokes various emotions in traders.

Some may become frustrated and even destroy their computers when the market doesn’t behave as expected.

Others might get too excited and make mistakes while analyzing subsequent trades.

And unfortunately, some may treat Forex with a gambling perspective.

However, to grow your small trading account, consistency is vital.

That is because the more time you spend with the market, the more experience you gain as a struggling trader.

It’s important to keep showing up and never give up, regardless of the market’s ups and downs.

Do Not Chase After Losses

When growing a $10 account or any size of the account, you do not want to chase after your losses or try to make up what you have lost in the market.

This is mostly attributed to greedy traders, who are not willing to lose any amount in the market.

And like I always say, “Loss is a cost of learning.”

Therefore, you must not chase after your losses.

If you have had losses and it has gotten to the minimum risk your trading account can hold, then stop trading.

The result of this is usually compounded losses. Losses upon losses, which you would not want to put yourself through.

Trading Journal:

The absence of a clearly defined trading journal is what hinders the growth of many traders.

A trading journal consists of your clearly defined and written trading strategy, risk management, and return on investment.

Having a journal not only helps you execute trades but also helps you to track your trading journey.

It helps you to easily review how well you have been performing as a forex trader and it exposes loopholes and where there is a need for improvement on your part as a trader.

Focus On The Process:

In every trade, you must always place more focus on execution and risk management rather than the monetary outcome of the trade.

Traders who make money their focus or want to get rich quickly only tend to lose money at the end of the day.

If you follow your laid-down strategy, then money will come after.

You must always focus more on the process of execution rather than the money.

Now It’s Your Turn

What did you learn from today’s post?

What issues are you facing when growing your small accounts?

Are you trading in a trending market? Do you perform the top-down analysis?

Either way, let me know in the comments

2 thoughts on “How To Grow A Small Forex Trading Account By 640% (Case Study)”

I enjoy your teachings mentor, I am currently working for my betterself_trading the Willis zone.

I really learnt a lot coach