With thousands of forex trading strategies out there, it can be overwhelming to decide which one to follow.

However, there is a simple solution.

To determine the best strategy for you, you need to consider your personal characteristics and trading style.

This will enable you to create a trading strategy that aligns with your individual needs.

For instance, if you prefer to hold trades for several days or weeks, swing trading could be an excellent option for you.

In today’s post, you will gain a comprehensive understanding of swing trading, including price action swing trading techniques that you can implement right away.

Key Takeaways

- Consider your personal characteristics and trading style in order for you to choose a suitable trading strategy.

- Follow the 7-step process discussed in this article.

- Swing trading suits those with emotional capability and limited time.

Trading Styles vs. Strategies

Before we proceed, let’s note the difference between trading styles and trading strategies.

Trading styles refer to the timeframe or length of time a trader is willing to hold positions, while Trading strategies are used to determine how those trades should be executed.

Generally, we have more trading strategies than styles.

This is because trading styles are used to describe a group of traders whose trading have common features while trading strategies are peculiar to every trader.

Do you now see the differences between them? Yes, I believe you have.

Let’s quickly run through the styles of trading we have. The popular ones are:

- Swing trading

- Day trading

- Scalping (often a subset of day trading)

- Position trading

It is now up to you to determine the style of trading to use.

What is Price Action Swing Trading?

Price action swing trading involves analyzing price movements in order to identify potential entry and exit points for trades at swing points.

With the help of price action swing trading, you can take advantage of both short-term and long-term market trends.

These swings are divided into swing bodies and swing points (which could swing high or swing low).

As you can see from the image above, more profit is usually made when you ride the swing body (up or down) using swing points as an entry in this case, down.

So, how can you get in at swing highs and swing lows? Do not bother too much.

The following simple 7-step process would help you get in at swing highs and lows. The last is a secret. So read on.

Step 1: Move to the monthly time frame and scale down

When trading generally, as I always say, the first thing you should do is to identify the overall flow of the river.

The monthly time frame helps to provide the overall sentiment of the market and can help you to forecast thousands of pips into the future.

You then scale down to the lower time frames like the weekly, to look for chart patterns and then the daily or 4-hour for swing entries.

A common thing when it comes to trading is, the higher the time frame, the stronger the signal given.

Hence, you would want to start off your analysis from the most reliable timeframe which is the monthly.

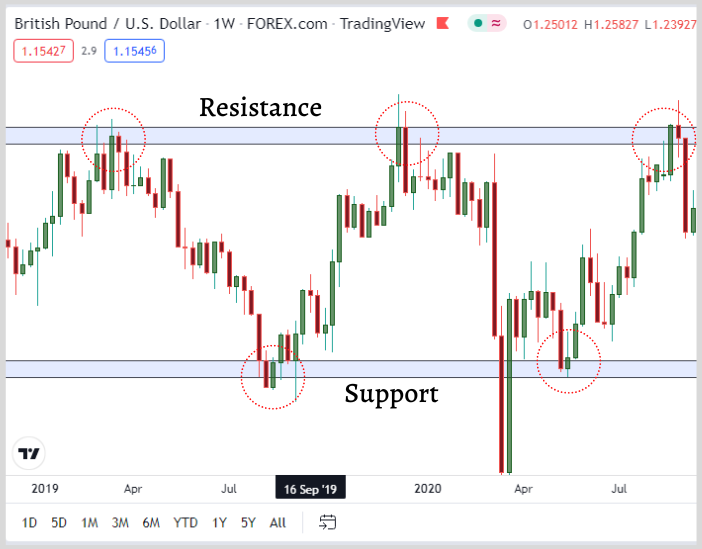

Step 2: Identify your key levels- Support and Resistance zones

It is undebatable that support and resistance is other very important step in swing trading because it is the foundation upon which most strategies are built on.

Support and Resistance are of two types which are:

Horizontal support and resistance

To make swing trading easier, it’s important to have these simple levels on your charts.

These levels give you a good starting point for identifying swings in the market and finding the best areas to aim for when trading.

To learn more about support and resistance and how to draw them, see this post.

Trendlines

Trendlines are another very vital tool when determining support.

and resistance zones.

They help to identify entries and exits in a trend and also, help to spot trend reversals.

To learn how to use trendlines click here.

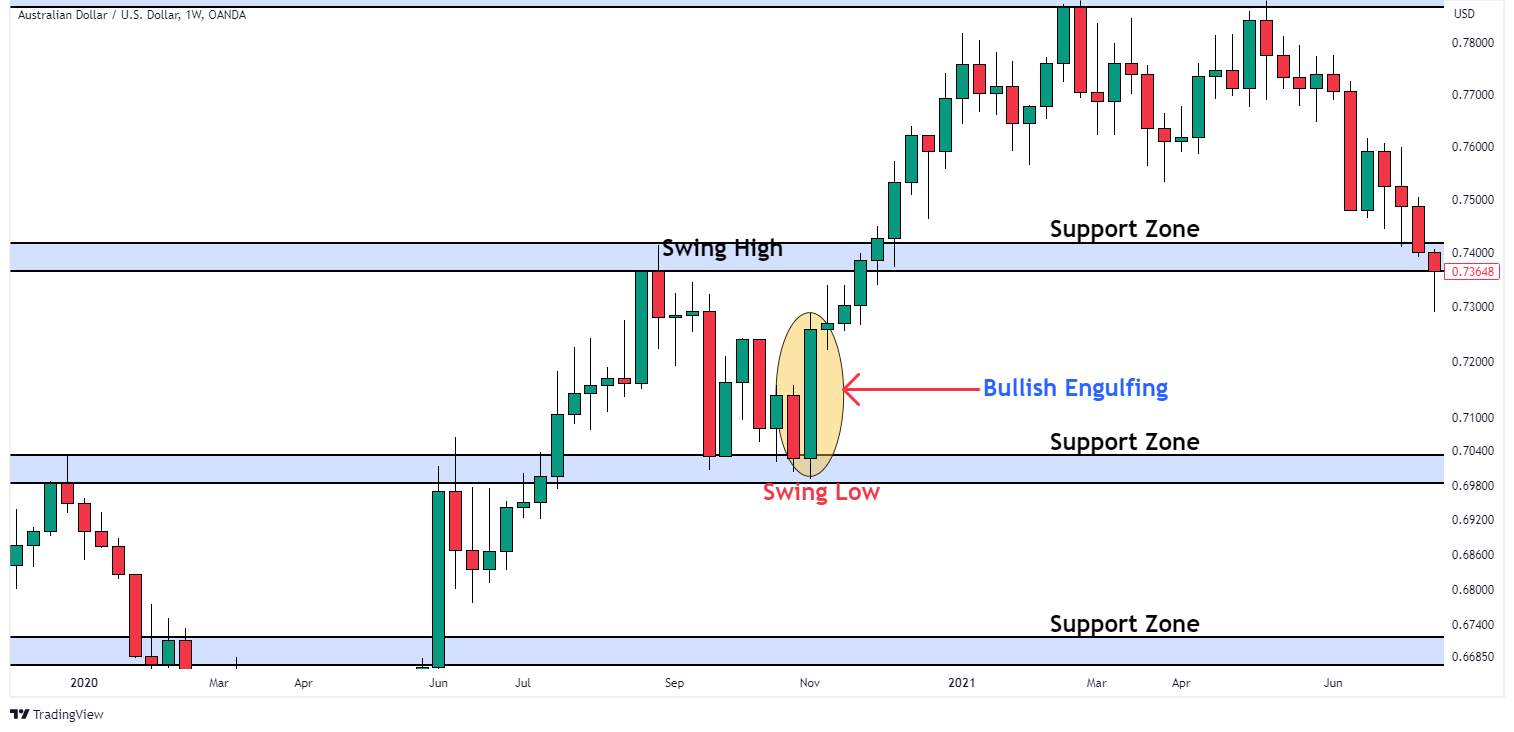

Step 3: Evaluate Swing Points

When you have had all your support and resistance zones clearly identified, you should now be on your entry time frame so as to evaluate your swing point.

This is where the swing points I mentioned earlier in the post come into play.

There are three metrics by which you can evaluate your Swing points.

These metrics are:

Uptrend: When the price is forming higher highs and higher lows, you can be sure that the price is in an uptrend.

Downtrend: Lower highs and lower lows are the metrics that can be used to determine that the price is in a downtrend.

As you can see, this is the opposite of an uptrend.

Range: A range is characterized by the sideways movement of price.

Though sometimes, range-bound markets do provide some interesting entries, as a newbie, you should avoid range-bound markets because they are subjected to high market manipulation.

Step 4: Spot Price Action Cues: Reversals and Continuations

Spotting price action cues is just a fancy phrase for watching out for price action indicators which can either be reversals or continuations.

When we are making higher highs and higher lows (uptrend) you would want to look for bullish continuation candlestick patterns such as the bullish engulfing to catch a buy.

See how to use the bullish engulfing candles to enter an uptrend.

Similarly, when we are making lower highs and lower lows (downtrend) you would also like to spot bearish continuation candlestick patterns like the bearish engulfing that can help you ride the sell down.

When trading, do not feel the compulsion to trade.

If your setup is there, take it. If it isn’t, leave the marketplace.

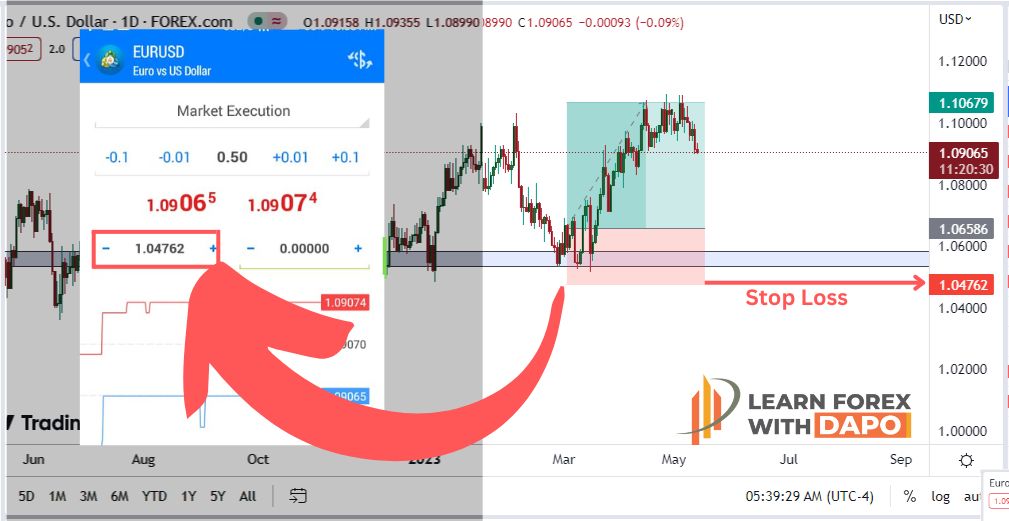

Step 5: Mark out exit points

There are different exit strategies that can be used in swing trading.

I would be discussing marking out your exit point using the price action swing point.

There are two exit points that need to be marked out when you place a trade.

They are:

Stop Loss: Stop loss is the target that you set at a swing point to help you exit the market when the price moves against you. It protects you from further losses.

Profit target: Your profit target is one that helps to take in and keep the profits realized when the market moves in your favor.

It also protects you from sudden changes in the market direction.

You set these exit points so as to know the amount of risk involved in every transaction you make.

It also shows you the potential profits that could be made should your profit target is hit.

Step 6: Calculate and Manage Risk

After step 5, the next thing you need to do is to calculate risk.

Let me give you an example of how you can calculate your risk.

Take for instance, you have a stop loss of about 50 pips at $10 per pip (i.e. using 1 lot size) it means your total risk is $500.

If your profit target is 150 pips at $10 per pip (i.e. using 1 lot size) it means your potential profit is $1,500.

This means, your risk-to-reward ratio is 1:3RR.

You can calculate your RR by dividing your profit by your risk.

In this case, $1500/$500= 3

From here you can deduce that the higher your RR the better the trade (but this is not in all cases).

As a general rule, your RR should not be less than 1:2 in order to make profits in the long run.

One common mistake that many traders make is risking too much on a single trade.

I advise that you risk no more than 3% on your best setups.

This means you should risk less than 3% on some others that you’re not sure of.

Step 7: Be Patient

Now, to the secret. Patience.

This is an attribute that is very important in swing trading and it is not common amongst many traders.

Warren Buffet said it best – “The stock market is a device for transferring money from the impatient to the patient”

It’s important not to force trades and to wait for the right trading opportunities to knock at your door.

By being patient and waiting for the right setups, you can increase your chances of success and avoid unnecessary losses.

Now to the moment of truth…

Is Swing Trading Right for You?

Well, with over a decade of trading experience, I have found swing trading to be the most profitable trading style.

Not only is it profitable, but it also affords you peace of mind and gives you time to do other things.

Like having some quality time with your family, reading your books if you’re a student, going to work if you run a 9-5, and many others.

Just because swing trading has worked for me doesn’t mean it would work for everyone.

Though I strongly advocate for it.

Swing Trading would be the best for you if…

- You have the emotional capability to hold trades for some days

Generally, swing traders hold trades between some days to weeks. This means, you should be ready to hold your trades overnight and over the weekend.

If you suspect the market conditions might change suddenly, maybe due to some upcoming huge new events or any other reason, you can close your open position ahead of the news release.

- You are schooling or running a 9-5 job

As you must have known from my story, I started trading from my college days when I still had to attend lectures to pass exams.

Yet I was still able to trade forex.

This is the kind of freedom and opportunity that swing trading offers you.

- Do you want to take just a few trades in a month or even in a quarter

Since swing trading works best on higher time frames, too many opportunities are not presented.

But when they are, they are the most juicy of all.

Hence, because they are slower to mature, you would only have to take trades a few times a month or quarterly.

Swing Trading would not be the best for you if…

- You have the emotional capability to hold trades for some days

Some others don’t have the emotional capability to hold trades overnight let alone a few days.

This is usually owing largely to their personality and sometimes, their strategies do not allow holding a position for more than a specific time period.

- You spend hours before your screen every time you place a trade

If you can be at your screen every time without not placing trades, then swing trading might not be the best option for you.

Some people have enough time to give to the charts and hence, they can monitor their trades while it runs.

As a newbie, you are usually at the risk of overtrading if you just stay glued to your charts.

- You don’t mind making small amounts on each position you open

As swing traders, you can make an average of at least 3% or more on each trade you place.

But short-term traders like scalpers and day traders don’t make that that much per trade.

Final Words

Swing trading is a very popular style of trading used by many professional traders.

Over more than a decade now it has proven to be a very profitable style of trading that also provides traders with peace of mind and freedom to run other businesses.

And finally, with practice, discipline, and consistency, you can become a successful price action swing trader.

Do you think you can be a swing trader? If yes, good luck with it.

But if not, share your thoughts with me in the comments section.

Frequently Asked Questions(FAQ’s)

What is Price Action Swing Trading?

Price Action Swing Trading is a style of trading that analyses price and uses swing points as points of entry and exit. Trades are usually open for some days to even some weeks.

What is the Best Strategy for Swing Trading?

The best strategy for swing trading involves the use of support and resistance as extensively taught in this article. Other strategies for swing trading include Fibonacci retracements and channel trading amongst others.

What time frame is the Best for Swing Trading?

The best time frame for swing trading is the combination of these three- the monthly, the weekly, and the daily, or sometimes the 4-hour.

Is Swing Trading easier than Day Trading?

Swing trading is easier than day trading. This is because you don’t have to be in front of your screen every single time and also, it provides you with enough time to do other things.

Do Swing Traders Make Money?

Of course! Swing traders make money and even more return on investment per trade.

1 thought on “Price Action Trading Strategy That Works For Swing Trading”

The day i started learning how to swing trade was the day my high blood pressure has started to reduce. Thanks Dapo Willis for helping me.