As a newbie or even as an experienced trader, one of the inescapable stages in trading is the joining of online or physical forums, seminars, or webinars where so many ideas are being shared.

But if you pay a closer look or attention, you would discover that one of the most controversial topics in trading is the better style of trading.

Just as old as trading is the seemingly unending old argument has always been between price action vs indicators.

Now I would be clear:

Am not a big fan of using technical indicators nor do I find them reliable throughout my 11 years’ worth of trading experience.

If I find it unreliable does not mean others don’t find it useful.

we also have traders who leverage indicators and still found success.

But during the early days of my trading career, I have tested over 100 trading indicators and would tell you for a fact that each has its own systematic approach to trading, which is why I am writing this post for you guys.

So am not criticizing but judging based on my trading experience.

Key Takeaways

- Personal experience influences the preference for each method.

- Indicators offer automation but may mask current price behavior.

- Price action allows for informed decisions based on present and past price movements.

- Both methods use price charts and market prices to determine trends.

So let us begin

Price Action Vs Indicators (The Battle Begins)

Every Price action trader usually says this a lot;

“price action is the king in trading as it doesn’t lag on information about current price action whereas indicators do“.

While indicator-based traders say it is a beginner-friendly way of trading and much easier than having to study a whole lot of candlestick and price action patterns when trying to trade price action only.

But are these assumptions true?

That is why, with so much research and experience of my own, I have come up with this article to put an end to this argument.

With that, I would start by giving an open-minded definition of both systems of trading, their differences and similarities, and my opinion about both ways of trading.

Indicator-Based Trading System.

Let me start by asking,

What is an Indicator?

Indicators are computer programs that employ the use of different lines or colors to represent past price actions, calculate certain price movement based on some set of calculations in the market, and represents the calculated price digits on a graph.

Any system that solely depends on the use of indicators to make trading decisions, is referred to as an Indicator-Based Trading System.

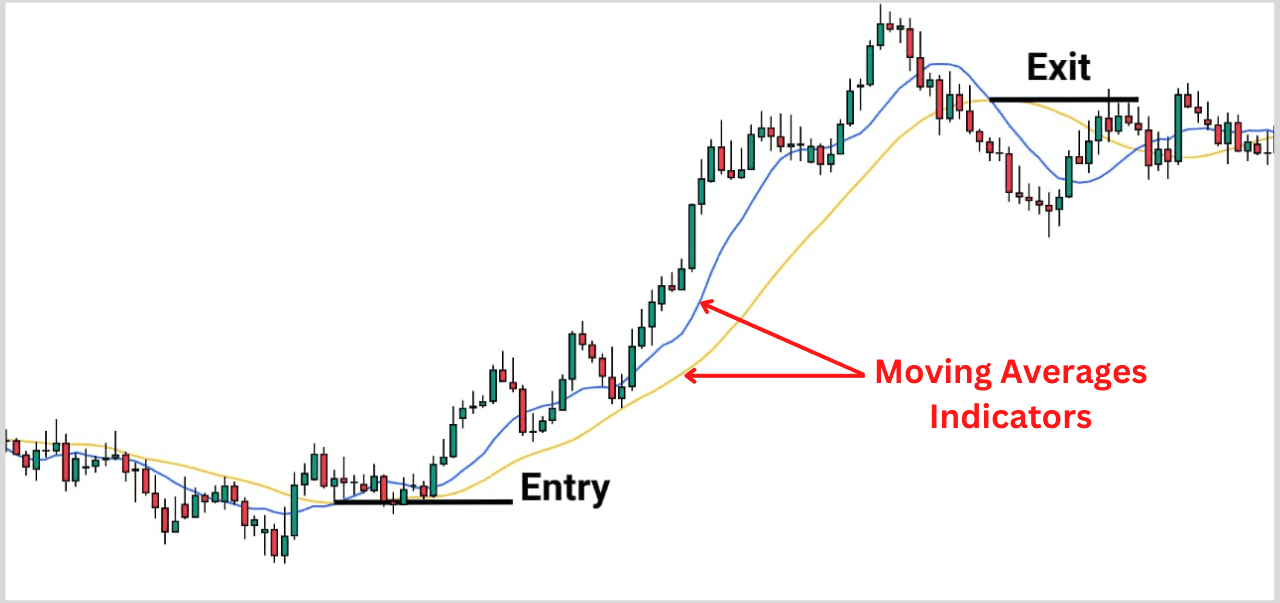

Above is an example of an indicator-based trading chart using Moving Averages.

Some of these are the following

- Moving averages

- Stochastic

- Bollinger bands

- MACD e.t.c.

As simple as that.

Advantages

- Indicators are independent of human influence in making trading decisions. They are not influenced by impulsive responses from an emotional trader.

- Indicators are relatively easier to follow since you are not making the decisions yourself. All you need to do is install your indicator on your trading platform.

Disadvantages

- The decisions of an indicator based on past price action mask the ability of a trader to see exactly the current price behavior and make trading decisions.

- Indicator-based systems are often subjected to market manipulation since indicators give every trader the same signal.

- It lessens the ability of a trader to make informed trading decisions. without indicators, this means traders in this category would be unable to make wise trading decisions.

Price Action-Based Trading System

Price action is the behavior of price– how, why, and when it moves over some time.

Therefore a price Action Based Trading System is any technique that relies solely on the movement of price over some time to make trading decisions.

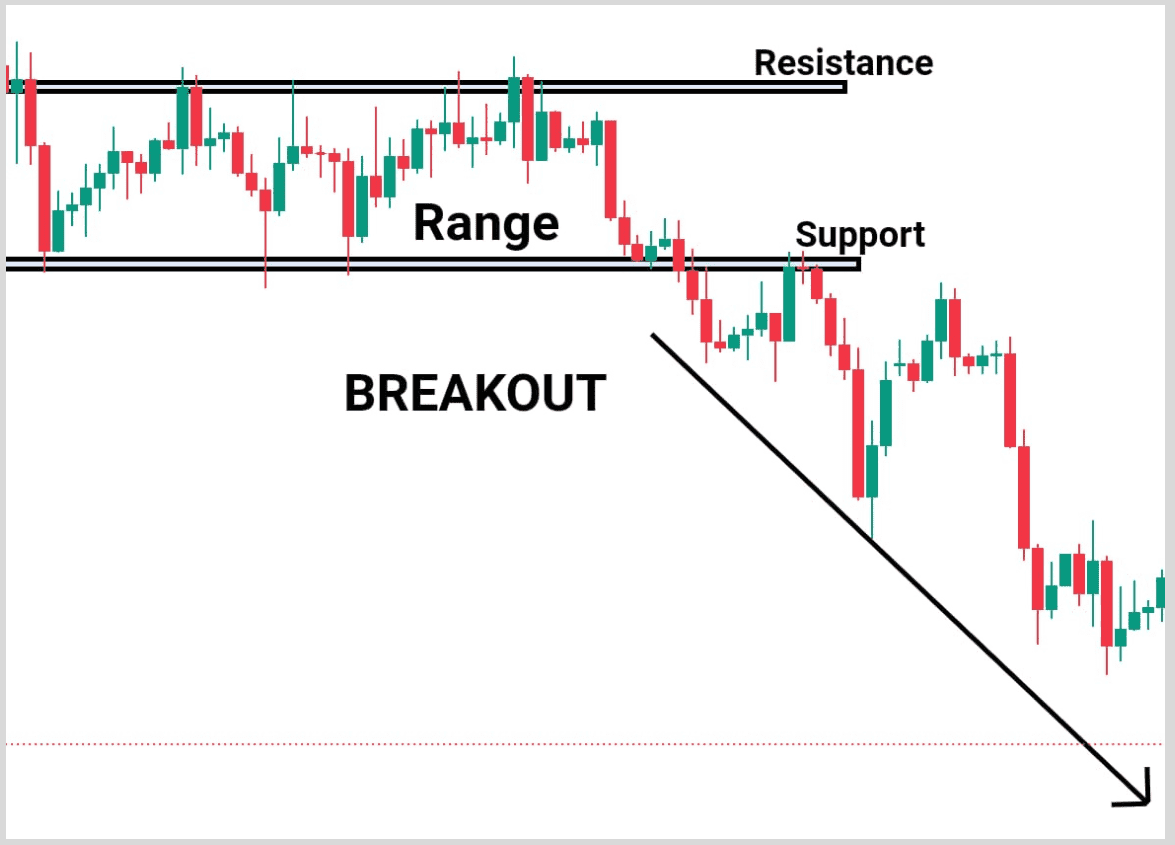

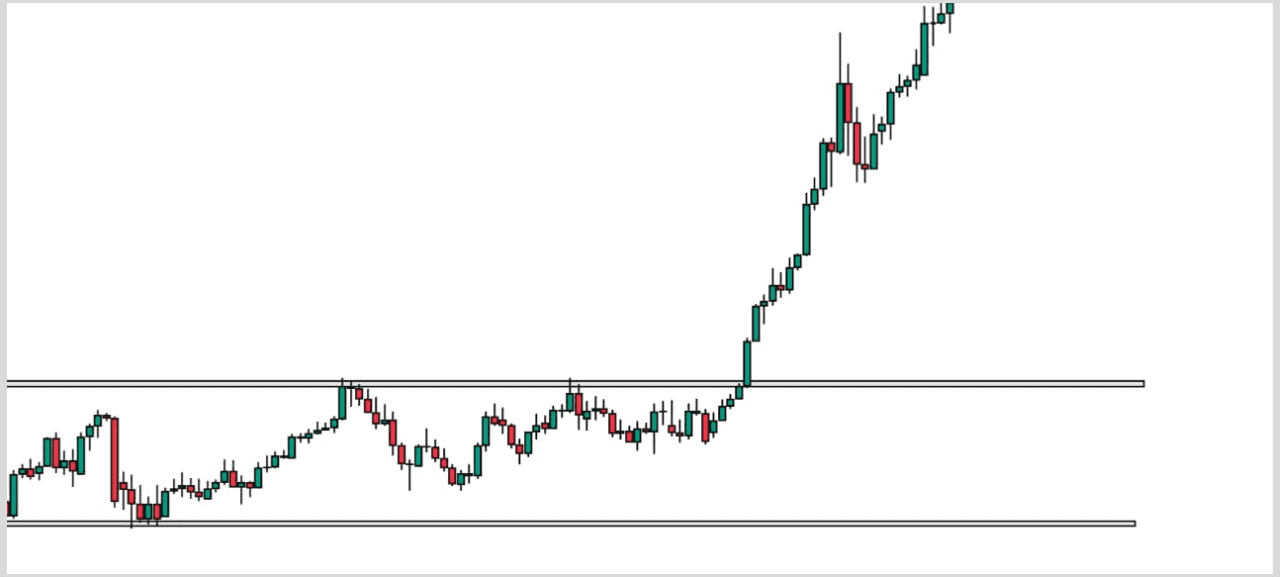

Above is an example of price action trading.

Some of the trading tools used in this style of trading are support and resistance levels, trend lines, candlestick patterns (engulfing candles, harami e.t.c.), and price action patterns (Head and Shoulder patterns, Double Tops, and Bottoms e.t.c ).

Advantages

- The price Action Based Trading System affords traders the liberty to make informed trading decisions. Since this system does not only rely on past price action present news and fundamental analysis can also be incorporated into this style of trading.

- This system is not only limited to the use of past price actions but also present price actions. This is an extension of the first point.

- It allows traders to develop their unique method of analyzing the markets. This puts traders in control of their decisions. As a trader who uses this system, you can come up with your method of trading by merely looking at the price.

Disadvantages

- Since trading decisions are made by humans, this method of trading is exposed to impulsive responses from emotional traders.

- Getting to the market and making an analysis could be time-consuming and therefore makes traders miss some profitable trades.

Having established and understood the advantages and disadvantages of both techniques.

Let’s now examine their differences.

Differences in Price Action Trading and Indicator-Based Trading.

Without beating around the bush, the important difference between these two systems of trading usually lies in the method they employ to project future market prices.

As earlier established,

Price action traders (technical traders) normally analyze current price movements in conjunction with past price movements to determine the potential direction the market is headed towards.

While indicator traders would usually tend to make their analysis solely based on past price action to project the current market price.

In simple terms,

Indicator traders are making their analysis based on only past price history while price action traders do this too.

As they incorporate the use of present price action to determine the future price of a particular instrument.

Let me give you an example.

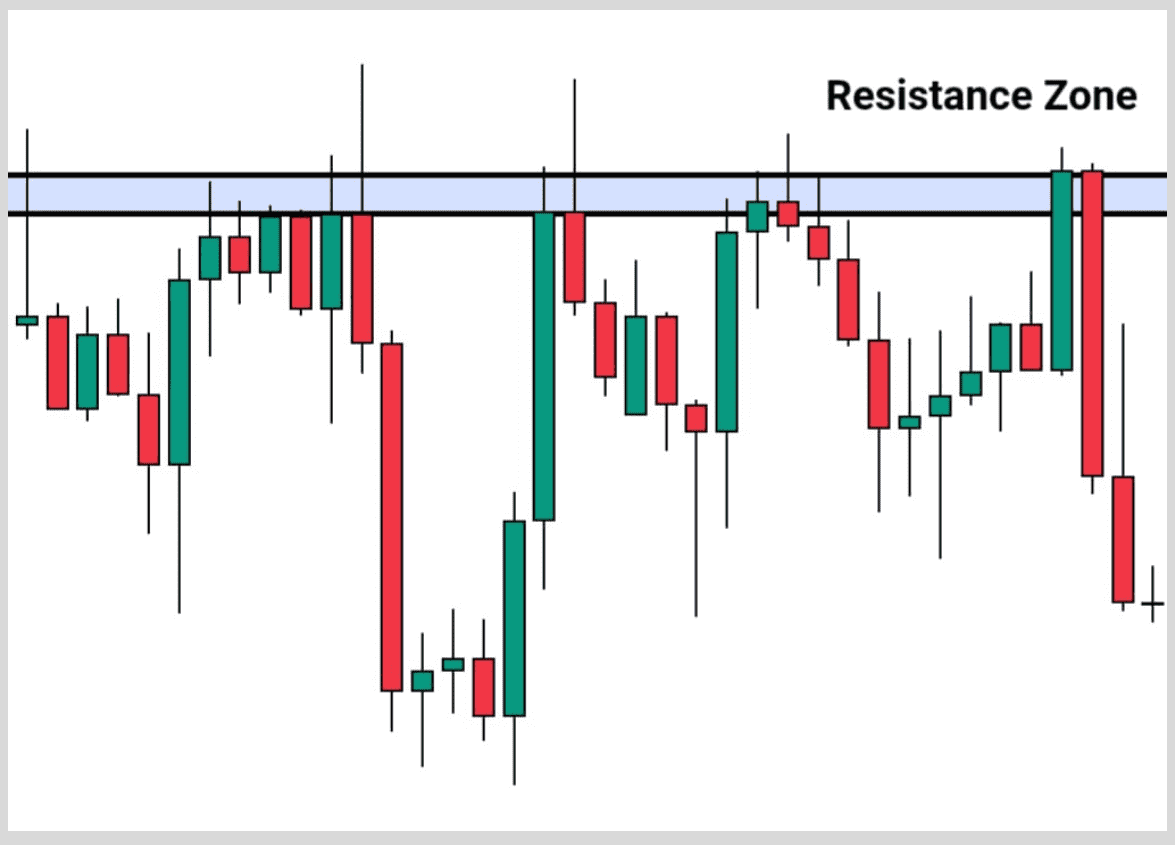

For a price action trader having drawn a support or resistance zone from the past, he/she then waits for the price to show a rejection from the level or a continuation from that level before jumping into any trade.

Let’s take for example, a price action trader who sees the resistance level as shown below.

He or she does not just set a sell limit order at the supposed resistance zone but waits for the price to show some kind of rejection such as the engulfing candles (bearish and bullish) or rejection candles (Doji or hammer) before he or she can place a sell entry from that zone or level, as shown below.

And this is how most price action traders combine the use of both past and present price action to make trading decisions.

Whereas indicator-based traders, their systematic approach to trading differs.

They make all their trading decisions based on the past.

Since indicators are based on only past price action, it is right to say that they do not implement the use of present price action to make their trading decisions.

For example, one of the most popular trading indicators is the Moving Average Indicator.

In using the moving average crossovers are usually the entry and exit for many.

Crossovers simply mean when one of the moving average lines has successfully crossed over the other.

Now the Moving Average crossover strategy is when a fast-paced moving average indicator crosses the slow-moving average indicator.

This means the trader would place both fast and slow-paced moving averages on the chart and wait for a crossover to determine the entry or exit.

When the cross occurs, the trader then takes a position in the direction of the fast-paced moving average

Below is an example

- Another very glaring difference between a price action trader and an indicator-based trader is the delay of entry in price movement.

A price action trader can respond immediately to the current price movement because the trader would have an already predetermined decision on what action to take provided the price fulfills all their conditions of entry or exit.

Whereas for an indicator-based trader, the price would have already given its direction before the majority of the indicators show the direction of the price.

This delay is because they react to past price movements especially when it comes to finding perfect sniper entry points in the market.

This argument is correct for all indicators no matter what type of indicator it is or who invented the indicator.

Indicator-based traders are always behind in current price movements.

- One of the most popular differences also is the comparison of an indicator-based trader’s chart to that of a Price action trader’s chart. What your chart would look like when trading with indicators is different from what it would look like when using price action only.

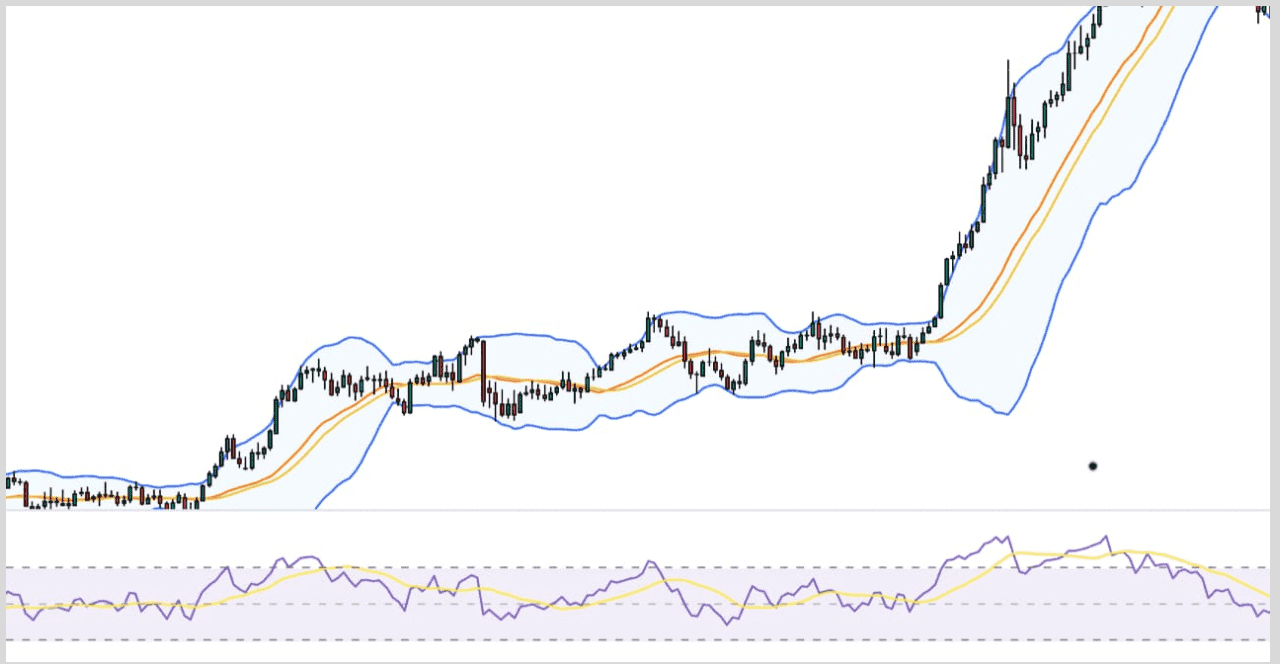

Above is an example of the screen of an indicator-based trader when trading with three indicators.

Many traders even use more than five different indicators on their charts all in a bid to determine where the next price is headed to.

I have added five of the most popular indicators used by traders to the chart.

You can see for yourself how confusing indicators can be on your screen.

It even gets worse when you realize each indicator has its special purpose.

It also makes it very difficult to identify current price action.

Above also, is how the screen of the majority of price action traders looks like in the same trade.

The example above is the image of how most price action traders look to enter the market.

The horizontal zones drawn across the screen are referred to as the support and resistance zone where price action traders look to take short or long entries.

This makes trading less confusing and easier to interpret.

- While Indicators are automatically drawn on the chart with the aid of a program on the computer, price patterns are usually drawn by humans for recognition.

- Many often argue that indicator-based trading is the best way and usually easier and faster for a beginner to understand, as the trader only needs to rely on the crossing of some easily visible lines on the charts, while price patterns can be difficult for a newbie to easily spot.

Note that “easier and faster” does not necessarily mean”more profitable“.

Since indicators are automatically drawn on the screen, making your own decisions using an indicator is relatively faster as opposed to when a price action trader is making his or her analysis which could be time-consuming.

However many of their differences might be, the Indicator-Based Trading System and Price Action Based Trading System have some similarities which we would uncover in the next section.

Similarities Between Indicator-Based Trading System and Price Action-Based Trading System

It is surprising how there could be similarities between these two styles of trading after having seen many differences between them.

But the similarities between these two trading systems I would like you to know are:-

- Both trading systems use price charts to make their trading decisions. Which means they both have a common source from which they extract information.

- Both trading systems use market price to determine the overall direction or trend of the market.

After having explained the different trading systems, their similarities, and differences, it is now high time I show you the method that I use, the one that is better and can make you profitable.

And that leads us to the Final Question?

Which of the two trading systems is better?

Now to determine the best trading system, I would weigh what works best generally.

Let’s start with indicators.

The premise behind the creation of indicators was that it was supposed to aid traders to make better-informed trading decisions about past price actions.

While the study of price action is very crucial to help traders better understand how the market moves, what forces are behind these movements, and how to use this movement to the trader’s advantage.

Comparing and contrasting the two, I have realized that Price Action would be better for any trader.

Let me explain.

Since I can, through the study of price action, determine past price movement and also present price action.

I strongly believe price action would be the best for any aspiring trader.

Though it may be hard to understand initially, in the long run, it is more profitable and easier to use than indicators.

But do I ignore indicators?

Yes and No.

They play some role in helping new traders.

If I will use any indicator, it would be after making my analysis based on price action only.

Here’s what I do.

After making my analysis based on price action only, I then sometimes tend to deploy the use of Indicators as an after-effect to confirm the following:-

- the trend of the market

- to identify exactly where my entries would be in alliance with my technical analysis tools

- to identify where my exits could be.

Now, note again that I only use these indicators after I have made all my trading decisions using price action only as this gives me a huge advantage in the markets.

Deploying them on my chart to use is just to see the accuracy or the lagging power of an indicator.

Final Words

I hope after reading this article, you have been able to understand the marked differences and clear advantages price action has over only indicators.

I don’t believe building a strategy based on indicators only is a good idea because the market would be a step ahead of you all the time, and you lose money because of your late reaction to the current price action.

With these, I have come to the end of this article.

Now I would like to hear from you.

What did you learn from today’s posts?

Either way, do you find price action methods as a good way to trade or the opposite direction?

Market actions give you an edge between price action and technical indicators.

I would love to hear in comments

Good luck with trading!