Are you tired of hearing conflicting opinions on the importance of backtesting in trading?

Some say it’s the backbone of any successful strategy, and helps you build up your confidence while other traders dismiss it as a waste of time.

But what if you could uncover the truth about backtesting and learn the secrets to building your confidence as a trader?

Look no further, because I’m here to guide you through the ins and outs of backtesting.

From understanding how to backtest price action strategies to discovering the benefits and shortcomings of this powerful tool, I’ve got you covered.

But that’s not all – I’ll also reveal essential guidelines for successful backtesting and share expert tips on how to use this technique to your advantage.

So, if you’re ready to take your trading to the next level, let’s begin this exciting journey together!

What Is Backtesting and Why Is It Important to Traders

Backtesting is the process of testing your trading strategy or model on historical data to see how it would have performed in the past.

It involves examining your strategy right before you start trading with real money.

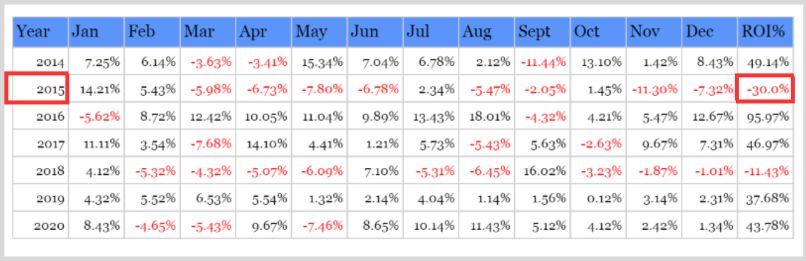

Here’s an example of what a backtest report looks like.

In the backtesting reports above, you can see how much was generated each month and every year for 7 years.

In 2016, you see that this strategy yielded a whopping 95.97% return on investment.

In 2015, the same strategy resulted in a massive 30% loss for the year.

This goes to show that while backtesting does not guarantee future profits, it certainly helps traders gain a deeper understanding of their strategies.

Imagine if the owner of this strategy had given up after the 2015 loss – they would have missed out on the huge profits they made in 2016.

Instead, by analyzing and improving their strategy, they were able to make small but impactful tweaks that yielded better results.

This not only increases the likelihood of future profits but also enables traders to move forward with more confidence in their strategy.

So, while backtesting may not always lead to immediate success, it can be a valuable tool in building a profitable trading strategy over time.

Reasons Why Backtesting Is Important To Traders

Backtesting is important to traders because it helps in:

Strategy Validation and Confidence Building

When you backtest your strategy on historical data, you will see how well your strategy has performed over a specific period of time.

Hence, you would be able to determine the consistent profitability of that strategy.

Doing this helps you to build confidence, conviction, and discipline in your strategy knowing fully well that your strategy has done well in times past.

Assessing your Performance

Backtesting allows you to assess the performance of your strategy with important metrics such as profitability, risk-adjusted returns, drawdowns, win rate, and average trade duration.

Using these metrics to assess your strategy, you would be able to identify the strength and weaknesses of your strategy.

This would help you make more data-driven trading decisions rather than emotional and impulsive decisions.

Optimizing your strategy

When you make some little tweaks to your strategy to meet some needed market requirements, it is called Strategy Optimization. More on this as you read on…

With constant backtesting, you would notice some loopholes that your strategy has, which can be improved upon.

By doing this, you allow your strategy the flexibility to adapt to various market conditions and still remain profitable.

Risk Management

When you backtest your strategy, you would be able to know the risk associated with it.

It also allows you to see the potential result that your strategy can yield per setup.

Hence knowing your risk to reward.

It helps you to set realistic profit targets, position sizing, and stop-loss levels.

Strategy Development

With constant backtesting, you would be able to see other recurring patterns in the market that are profitable.

This helps you develop new strategies.

Now, let’s discuss some general guidelines for backtesting.

General Guidelines On How to Backtest

- Define your strategy parameters: Clearly outline the specific rules and parameters that define your trading strategy before conducting the backtest.

- Select the financial market and chart timeframe of your choice: Choose the market and timeframe that align with your trading strategy to ensure accurate testing and relevant results.

- Look for trades: Use historical data to identify potential trades based on your defined strategy parameters.

- Analyse entry and exit signals: Evaluate the signals generated by your strategy for both entry and exit points, considering price patterns, or other criteria.

- Record all trades and calculate gross return: Keep a record of each trade, including entry and exit prices, and calculate the gross return to assess the profitability of your strategy.

- Calculate net return: Account for transaction costs, such as commissions or spreads, and subtract them from the gross return to determine the net return.

- Calculate percentage return: Express the net return as a percentage of the initial investment to understand the overall performance of your strategy.

So, how many types of Backtesting do we have?

Types Of Backtesting.

There are broadly two types of backtesting. These are;

- Automated Backtesting and

- Manual Backtesting.

Let’s explain each one of them.

Automated Backtesting

Automated backtesting makes use of some kind of software that specializes in simulating trades based on historical data.

It allows you to test your trading strategies efficiently and quickly, as the software executes trades based on your predefined rules.

This type of backtesting saves your time and effort, making it ideal for traders who prefer a systematic approach, usually indicator-based traders, and want to analyze large amounts of data effortlessly.

Manual Backtesting

To the name “manual”, this type of backtesting involves reviewing historical data and simulating trades by hand.

While this backtesting method requires more time and effort compared to automated backtesting, it allows for a deeper understanding of market dynamics and the development of a trader’s intuition.

Manual backtesting is a great option for price action traders who need more hands-on experience, as it provides an opportunity to fine-tune strategies, analyze individual trades in detail, and gain valuable insights into market behavior.

At this point, you must have realized that as a price action trader, you may not be able to follow the aforementioned general guidelines because it requires specific rules.

But we know that as price action traders, the market does not always present the exact same setups every time hence the need for some little tweaks while backtesting.

So the big question is how can you properly backtest as a price action trader?

How To Properly Backtest As A Price Action Trader

You can know how to properly backtest as a price action trader when you ask yourself the following questions;

- Are your key levels relevant to the current price action and profit target?

- What is the current market phase and how relevant is your setup to this phase?

- Are there other contending factors against your trade?

Let’s now break it down.

Are your key levels relevant to the current price action and profit target?

Traders often plot all the key levels they see on the chart like this.

Meanwhile, not all these levels would be relevant to their entries and exit!

Having all these key levels drawn on your charts can even cause confusion thereby reducing the quality of your entry and exit.

But as a professional price action trader, you should draw key levels that are important to current price action and profit target when backtesting and even in live markets. Like this

What Is The Current Phase of The Market and How Relevant Is Your Setup To This Phase?

The next question to ask yourself after mapping out your relevant key levels neatly is, What Is The Current Phase of The Market, and How Relevant Is Your Setup To This Phase?

Let’s break this down.

First, What is the Current Phase Of the Market?

The current phase of the market is what makes your setup relevant.

Not all setups are useful in all market conditions.

From previous knowledge, we know that the market has three phases which are; the trending, accumulating(range), and distributing(range) phases.

Now, let’s take for example this GBPUSD trade.

As you can see the market is in a range and the best setup in a range is to catch the breakout, right? Yes.

So, you would want to use that kind of setup in this market condition and test accordingly.

Let’s take a look at another example, this time a trending market phase.

As you can see, this is an uptrend and the best strategy to use in an uptrend is the continuation strategy.

Do you now see where those little tweaks in strategy come into play?

In short, different market phases require different strategies.

Are there other contending factors against your trade?

Other contending factors against your trader are another thing to consider.

You would check for reasons why your proposed entry wouldn’t play out as you would expect.

Take for example this GBPUSD trade.

You have spotted a beautiful sell setup.

Only for you to check for contending factors and find out that the price is approaching a very strong support zone.

So what do you do? You stay out!

Look below what would have happened if you hadn’t stayed out!

Price would have treated you so badly!

So, with these questions, you should be able to backtest your strategy successfully without jumping from one strategy to the other.

Now, here is the thing.

You should always leave some side notes on your thought process as to why you took the trades when backtesting.

But how do you do this and why is it relevant?

Screenshot your trades with some side notes on your thought-process

As I was saying earlier, leave some side notes on your thought process and why you took every trade.

This helps you to understand your strategy even better and provides you with a source that can reignite your memory when out of a trade for a long time. Maybe after a break.

This doesn’t have to be complicated or hard.

It can be as simple and clean as this.

Now as a guide, I highly suggest you:

- Make a backtest file of more than 100 historical trades with screenshots of your thought process

- Backtest a minimum of 10 trades per market (so that you expose yourself to the dynamics of different types of the market)

- Have trading software that hides prices or has a replay button (to avoid being biassed when making a judgment)

There you have it.

Backtesting Vs Forward Testing

At this point, you have known what backtesting is. So let’s go straight to forward testing.

Forward testing is the testing of your strategy using real-time price action to test your strategy as opposed to the use of historical price action in backtesting.

This is also known as paper trading or demo trading.

In forward testing, you get to experience how it feels to have your money running live in the marketplace especially if you guide the demo money as though it was yours.

Through this, you would develop emotional strength that would help you get prepared for what is ahead in real-life trading.

You can also make necessary tweaks to your strategy by forward testing.

So which of them is better? F.orward Testing Or Backtesting

Spoiler ALert: none is better than the other!

You can use both of them to get the most optimal results.

I’ll explain.

Since price does not only depend on what has happened in the past, testing it with real-time data helps to solidify your trading system.

Also, since you cannot spend two to three years forward testing real-time data with only one strategy, backtesting would be a better option since price does act in a similar way to the way it has acted before.

So there you have it!

Before I finish, let me share with you a trading software that you can use to manually practice backtesting using the question metric that I shared with you earlier.

The name of this software is TradingView.

This is a free, all-encompassing charting software that not only provides the needed backtesting facility but also provides real-time data for thousands of financial instruments.

Did you see how I made use of it in my just-explained point above?

Good!

The most fun aspect of this is, you are not required to open any brokerage account with them.

You can also forward-test using paper trading with this software.

They are the best for manual backtesting.

Conclusion

In this article, you have learned some new points which are;

- Backtesting helps to build your confidence in a strategy by assessing its consistency and profitability over time.

- Backtesting helps you to identify a strategy’s strengths and weaknesses through the metrics which have been discussed in this article.

- Backtesting is essential for effective risk management, allowing you to determine realistic profit targets and position sizing.

- As a price action trader, you might not be able to follow some static rules as the market will not always present the exact same pattern over and over again.

FAQs

Is backtesting worth the effort?

For the most part, Yes. Backtesting is worth the effort. But this should be done in conjunction with forward testing.

Are there any backtesting Indicators?

Yes, there are backtesting indicators. Using tradingview, you have about 160 scripts on how to use these available backtesting indicators.

Is backtesting the same as paper trading?

No, they are different. Paper trading is the same as forward testing which you have learned in this article.