I went from $0 to $300M in profitable trading for 13 years.

Here’s What People Get Wrong.

Most people think my success in trading relies solely on strategy.

Sure, my strategy deserves a lot of credit.

It’s the reason I am where I am today.

A rock-solid, battle-tested system that makes me right 8-9 times out of 10.

Sounds great, right? But here’s what nobody tells you:

Being right 8-9 times out of 10 doesn’t just happen.

- It’s not luck.

- It’s not a magical indicator.

It’s the result of relentless backtesting, constant tweaking, and adapting to market conditions like a chameleon on caffeine.

What do I mean? For a strategy to be right 9 out of 10 times, you must have proof.

And proof doesn’t come from gut feelings or a couple of lucky trades.

It comes from data. Cold, hard, undeniable data.

And this is where 99% of traders fail.

They think the strategy is a one-and-done deal.

They take a winning setup, trade it a few times, and assume they’ve cracked the code.

Then, boom—one market shift later, they’re crying about “Market manipulation” while their account gets nuked.

That’s why journaling is the secret weapon.

Not the sexy, hype-filled kind of secret. The boring, grind-it-out, data-driven kind.

The kind that separates million-dollar traders from keyboard warriors debating Fibonacci levels on Twitter.

Journaling forces you to be honest.

It shows you:

- What works

- What Doesn’t

- and what needs fixing.

It’s the difference between gambling and trading like a pro.

So, if you’re still out here looking for the perfect strategy, stop.

- Start tracking your trades.

- Analyze your mistakes.

- Adjust, improve, and repeat.

Because in the end, the strategy isn’t what makes you rich. Mastery does.

Think of it this way?

- A filmmaker maintains a journal to outline scene ideas, camera angles, and storytelling techniques.

- A fitness coach keeps a journal to log client progress, workout plans, and nutritional guidance.

- A historian keeps a journal to note important dates, research findings, and historical interpretations.

The same goes for trading because highly accurate pattern recognition is the key.

- Newly Built In Backtesting Software

- Advanced Dashboard and PnL percentage

- Stocks, Options, Futures, Forex, and Crypto Broker Integration

- Calendar view and Real-time analysis

- Broker API Sync for seamless trade imports

- Track your bad habits and expectancy

- Custom Templates for personalized journaling

- Replay & share trades with mentors to stay accountable

Limited Offer: Use Discount Code “FX20″ for 20% Off on any Subscription Plan!

What is a Trading Journal?

A trading journal is a record-keeping resource that does three crucial things:

- Documents your trades

- Tracks your trade performance

- Analyzes your trading strategy over time

Anything other than that, you just have a pile of notes, not a real journal.

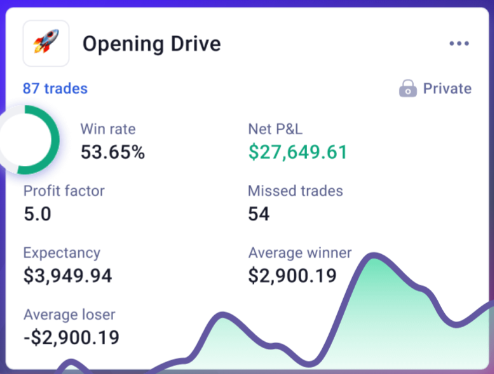

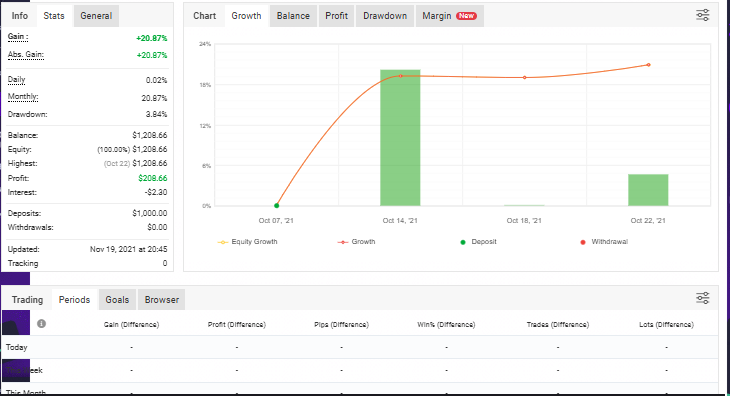

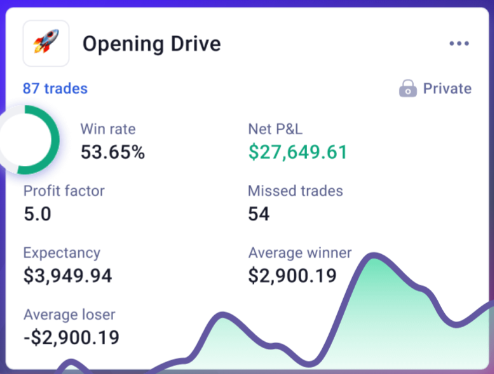

To most traders, a trading journal is just a collection of charts, PnL graphs, and entry/exit logs that look somehow like this.

But mine? It’s not some fancy equity curve or a basic win-loss tracker.

This is what my trading journal looks like.

And here’s the kicker—this exact method of journaling my trades made me $300M in trading.

I’ll break it down for you in a bit.

Stay with me.

What Should a Trading Journal Contain?

Now, notice from my definition of a trading journal—I didn’t say tool.

I mentioned record-keeping resources because most traders define it as a tool, a diary, or a booklet.

But in reality, a resource can be anything—tools, booklets, documents, or even a combination of all three.

A trading journal is not about what you use, but how you use it.

The goal is simple:

- Record data

- Analyze patterns (Before and After)

- Refine your strategy

If you’re not doing that, you’re just scribbling notes, not journaling like a pro.

Most traders, when they hear about a trading journal, think of records things like:

- An equity curve over time

- Risk-reward ratios

- Number of trades placed

- Time and dates of trades placed

- Average PnL

And they’ve got it all wrong.

Trading isn’t just about sticking to one system alone. Without the right psychology, even the best trading system becomes vulnerable.

The Missing Link: Trading Psychology

You can study the best trading methodology—even copy mine—and still not be profitable.

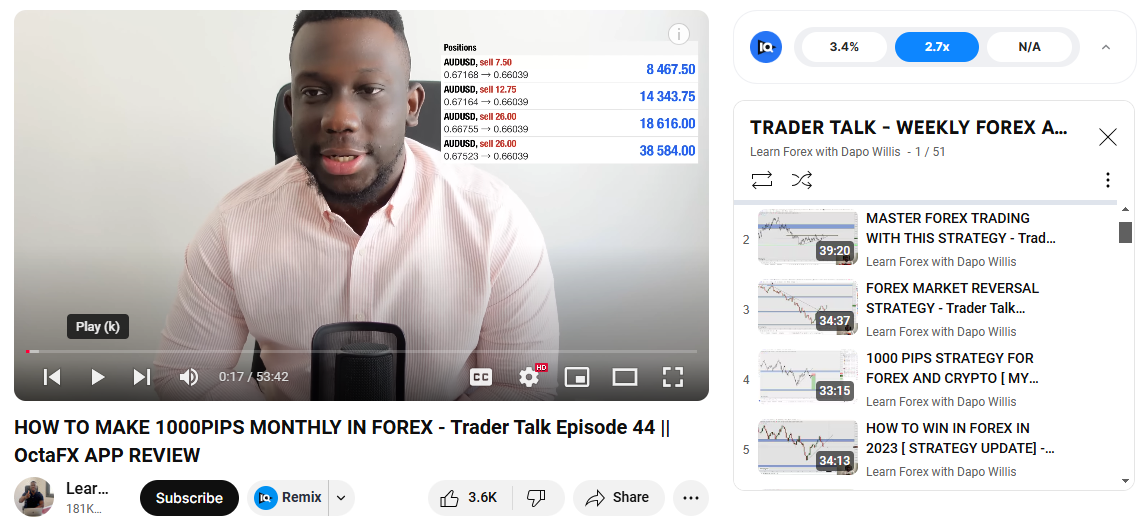

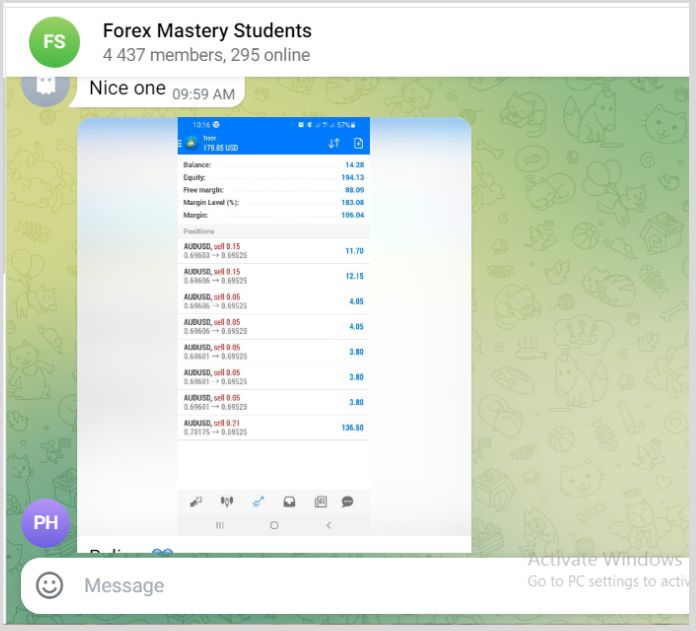

Unless you’re part of my forex mastery students Killing it..{because they know the secreets}

Now back to the main story.

Even studying the best trading strategy from a mentor doesn’t always guarantee your success. Because you’re not mastering the emotional side of trading.

Patience, discipline, and emotional control separate winning traders from the rest.

Let me explain:

If you only journal your P&L, you’ll see numbers, but you won’t understand why you’re making or losing money.

But when you track how you feel before and after trades, you set yourself up for success.

Don’t get me wrong—strategy works.

But failing to stick to it during rough patches and letting emotions take control? That’s where traders fail.

An emotional trader is a Bad trader.

So how do you track the emotional side of trading?

For me, it’s not about writing—it’s about expression.

That’s why my journaling system isn’t a notebook—it’s a series of prerecorded videos.

Before I place a trade, I record my thoughts. After the trade plays out, I revisit the video, analyzing my mindset.

That works for me. Traditional note-taking? Not my style.

Taking notes isn’t bad, but the key is documenting your emotions along with the basic metrics—P&L, number of trades, and patience level.

Because in the end, mastering emotions is what makes a real trader.

What Do You Record In a Trading Journal?

Psychological factors:

- Emotions experienced during the trade (greed, fear, overconfidence)

- Any biases that may have influenced decisions

Strategy Information:

- Trading strategy used

- Technical indicators or analyses used

- Risk management parameters (stop-loss, take-profit levels)

Market Analysis:

- Most traded Pairs and success rates on those pairs

- Market conditions at the time of entry

Why Do You Need A Trading Journal:

Let me tell you a little story.

In my early years of trading, I was profitable, but my accuracy wasn’t anywhere near the 90% I’m confident in today.

Then, I noticed something.

Anytime multiple confluences lined up on a trade setup, it tended to play out 9 times out of 10.

For example, when I saw:

- Fibonacci retracement

- Trendline support

- Key resistance level

That trade was almost always a winner. And when I noticed this pattern, I started stacking in aggressively.

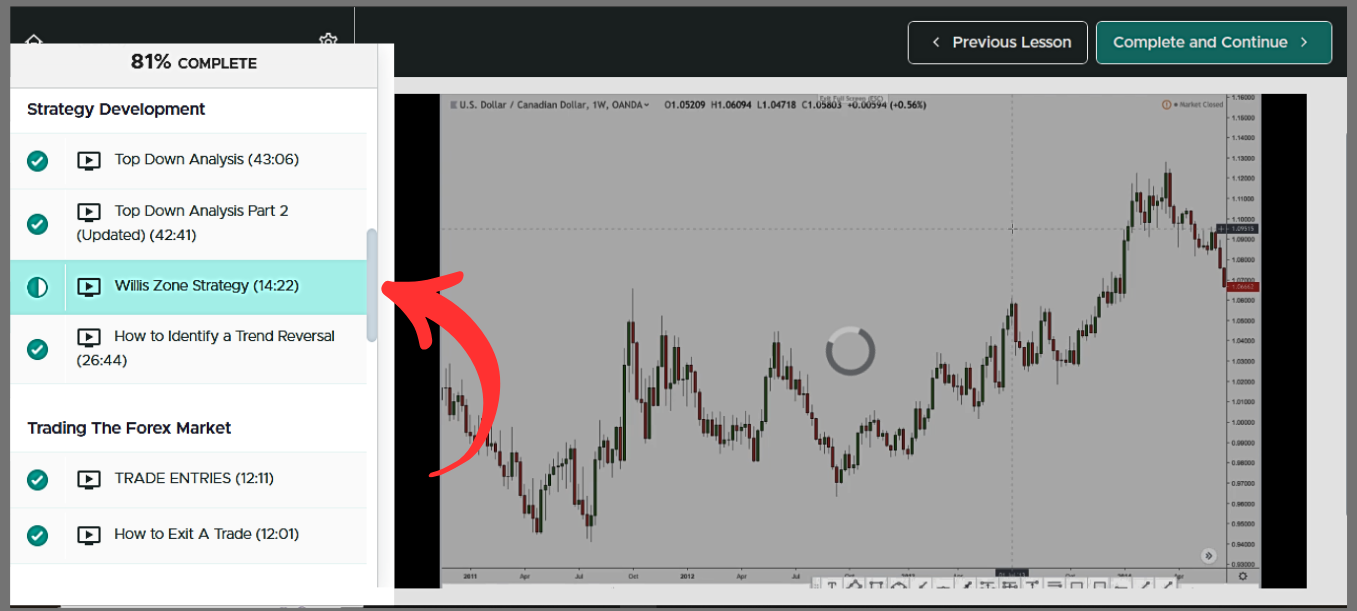

Thanks to my journal, I identified this edge and spent just 14 minutes teaching my students this approach.

In other words: A trading journal helps you identify you:

#1: It Builds Your Levels Of Confidence

A trading journal tracks your progress and reveals patterns in your trading.

When you see documented proof of consistent wins under specific conditions, your confidence skyrockets.

If you notice your swing trades perform best when certain indicators align, you’ll be more confident executing similar setups in the future.

#2: It Identify Your Strength and Weakness

Your journal acts as a mirror, showing both your strengths and weak spots.

You might discover that you manage risk well but struggle with emotional control during volatility.

Knowing this allows you to focus on improving weaker areas, like sticking to your plan during uncertain market conditions.

#3: Finding High Probability Trades

By consistently recording trades, you’ll notice which setups deliver the best results.

For instance, you might find that your best trades come from a combination of key technical patterns.

This insight lets you refine your strategy and focus on setups with a proven track record of success.

Best Trading Journal To Use:

Not all trading journals are created equal.

Based on feedback from over 3,000 students, here’s a list of the best trading journals available today.