Understanding market psychology can be a very stressful and tiring one especially if you don’t learn from the right source.

But in this article, I would simplify it such that you would be able to have a grasp of this topic at once.

Let’s dive right in.

As I said earlier, I know the financial market seems like a complicated system that is affected by many factors.

Factors such as economic data, geopolitical events, and sentiments on how individual investors feel about the market.

What Does Market Psychology Mean?

Market psychology simply means how people i.e investors who trade on the market, feel as a collective since the direction of the market is determined by the majority of people participating in the market.

The psychology of the market is an important part of it.

As traders, especially technical analysts, we have access to an important tool that can help figure out how the market feels and predict how prices will move.

So, What Does It Mean When Prices Move?

Price action trading is a style of trading that doesn’t require you to make decisions using technical indicators, rather you use price movements majorly (learn more).

Price action traders believe that changes in price are the best way to tell how customers feel about a market hence, determine where the price would be headed.

We look at and make use of price patterns, levels of support and resistance, and trend lines to identify possible trading opportunities and make decisions about trading based on reliable information.

Usually, price action traders don’t make use of information from news events and other fundamental driving factors. Instead, we look at what the market tells us or what we can interpret from the movement of price.

Price Action and What Makes It Up

A price action analysis is broadly made up of the following three parts:

Price Patterns:

This refers to how the price of a financial security moves and changes over time in consistent recurring patterns and predictable ways.

For further simplification, price patterns can be divided into three groups:

- Trend

- Range

- and reversals

Price trends are determined when price heads in a direction over long periods of time.

When the price of a currency moves up and down within a range, then the price is said to be in a ranging phase.

While market reversals occur when the price of a financial instrument goes in the direction opposing its former one.

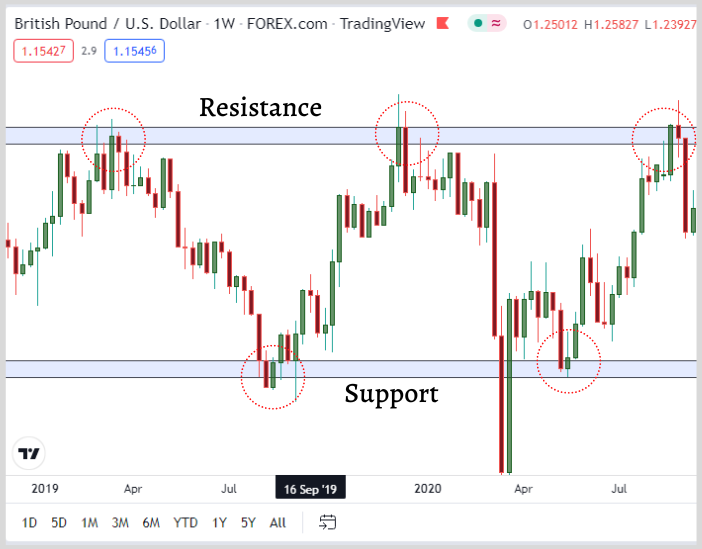

Support and resistance are price points where an asset’s price tends to bounce back and forth for a period of time.

These back-and-forth movements can sometimes last for long periods, and at times can be for a short period.

Now, let’s look at the difference between these two price levels.

Support levels are points in the market where the price of a particular financial instrument tends to stop going down and start going up again.

while Resistance levels are price points where an asset’s price tends to turn around and start going down.

A “trend line” is a line drawn on a trading chart that connects at least two price points.

There are many different techniques to draw trend lines.

These lines are used to figure out both the direction of the trend and when it might change.

The Crucial Role That Price Action Plays In Trading

Since price action is a very basic and simple way to trade, it helps traders understand the market as a whole better.

Price action traders are able to make smart and informed trading decisions based on how the market feels because they use the information that the market gives them.

Price action trading gives traders a better method to find potential trading opportunities and a more economical way of managing their risk.

The Psychology of the Market in Relation to Price Action

Market psychology has a big effect on how prices move in the market. You ask me how? keep reading.

Let’s first define the term “market psychology“.

Market psychology refers to the beliefs, attitudes, and expectations of all market participants as a whole, this includes traders, investors, banks etc.

When looking at how people act on the market, the emotions of those people i.e market participants are taken into account.

The way the price of a currency goes up and down shows how people feel about the market.

Different kinds of people who take part in the market and how they think about it

In the financial market world, where different people with different opinions come to make a decision, there are many different types of market participants, and each person or group of people has their way of thinking.

As traders, you need to know the different people engaging in the market so that you can analyze them based on your own perspective, emotional quotient, and risk tolerance.

Retail traders:

These are people who use their own money to invest and trade in the financial markets like everyone else.

However, most retail traders are more affected by their feelings and more sensitive to fluctuations in the market.

These types of traders often follow the market trend, which means they usually buy when prices are going up and sell when prices are going down as every price action trader does.

And most importantly, these are traders that do not have large capital to move the market.

Hence, their capital does not affect the market.

This is the category of trader you and many other market participants belong to.

Next, we have.

The Institutional traders:

So who are they? Institutional traders are simply professional traders who work for financial institutions like banks and hedge funds and the likes of them.

Simply put, Institutional traders are professional traders who trade on behalf of financial institutions.

Institutional traders have stronger and more sophisticated trading tools that overall tend to make them stronger at analysis and strategy.

This is not to say that retail traders don’t have stronger analysis, but when comparing, Institutional traders are more sophisticated.

When it comes to trading, they use both fundamental and technical analysis to decide what to do.

Lastly, we have the

Market Makers:

Market Makers are market participants that buy and sell assets to keep the market liquid.

Which is why they are referred to as “ Market makers”. Market makers usually show less emotion and pay more attention to how they control their risk.

And that’s about it for the types of market participants.

Learn More: Market Makers Vs Prop Firms

How Market Psychology’s Key Principles Affect Price Action

As price action traders, we need to understand some basic market psychology rules.

First is, Why supply and demand work the way they do.

The supply and demand principle states the theory that the movement of a financial instrument is largely dependent on the equilibrium (balance) between those who are willing to buy the market and those who are willing to sell the market.

This means that when there are more buyers than sellers in the marketplace, the price of financial security tends to go up, and when there are more sellers than buyers, the price usually goes down.

The idea of support and resistance:

The support and resistance theory simply says that the price of an asset tends to bounce off of levels of support and resistance.

This helps traders utilize support and resistance levels to figure out if a market trend is ready to change its overall direction or not.

The “principle of trend”:

This principle is based on the assumption that the price of an item will keep going in the same direction for a long period provided there are no signs of possible trend reversals.

This helps traders to figure out both the direction of a current trend and any possible changes in the overall trend.

The momentum principle:

This principle says that once an asset’s price starts moving in a specific direction, it will usually head towards the same direction for some time.

This helps traders utilize the energetic movement of prices to help them detect possible trading opportunities.

Understanding Price Movement Using what you know about how the market works

We as traders learn better and more efficiently about how the market works by constantly keeping an eye on how prices move in several different ways.

As traders, we all can view the market in different ways and I will show you that to broaden your knowledge.

Firstly, you as a trader can figure out how people feel about the market by looking at pricing patterns, which they can use to spot price trends.

An uptrend trend, for example, shows that market participants are optimistic about how the asset might do in the future, while a downtrend trend shows that market participants are discouraged about how the asset might do in the future.

Do you get it now? If so, let’s bring all these theories together and how to use them.

By checking at support and resistance levels, traders can figure out how the market is acting. But the question is how?

Here is how,

Support and resistance levels help traders figure out how the market is doing.

For example, if the price of an item bounces off a level of support, it means that people are buying the asset at that level and they believe that the price will continue to go up.

On the other hand, if the price of an item bounces off a level of resistance, it means that people are aggressively selling the asset at that level and the price may go down.

Also, we traders can figure out the sentiment of people about the market by looking at the trend lines.

For example, if the price of an asset is going up continuously, especially after minor retracements or pullbacks, it means that people in the market are optimistic about the asset’s future worth.

On the flip side, if the price of an item is going down, it means that people in the market are not encouraged about the item’s future value.

With the help of momentum, traders can find possible trading opportunities.

The momentum and energetic moves of the market can be used by traders. Take for example now, if the price of an instrument is going up aggressively, this means that people in the market are optimistic about the asset’s future value.

If the price of an item is going down very strongly, it means that people in the market are discouraged about the instrument’s future worth.

Conclusion

To sum up, traders may get a lot out of studying how prices move to learn about the psychology of the market. Price action gives traders a better way to identify potential trading opportunities and a better way to handle risk.

As you have learned, by constantly observing price patterns, support and resistance levels, and trend lines, traders can identify how market participants feel as a whole.

So, now that you have this information you can determine how the market will move in the future and make good trading decisions based on the information the market gives them.

It is important to remember that trading always involves inherent risk, and you should always use good risk management strategies so that your chances of losing money will be low.